What makes Texas law firm marketing different? Texas is a pure tort state with nearly 100,000 active attorneys and some of the highest-spending legal advertisers in the country. Firms like Thomas J. Henry and Jim Adler spend $20 million to $40 million each on TV alone, which drives up digital ad costs for everyone. A single click on “truck accident lawyer Houston” can cost $800 to $1,000. But Texas also has massive gaps: the I-35 and I-10 corridors generate thousands of trucking cases, the Permian Basin and Eagle Ford Shale create oilfield injury claims that require specialized content, the Rio Grande Valley has one attorney per 805 residents, and 40% of the state population is Hispanic. Argota Marketing builds Texas campaigns around the cases and corridors the Titans process impersonally or ignore entirely.

If You’re Trying to Outspend the Titans, This Page Isn’t for You

If your firm has a $30 million ad budget and a mascot name that people search instead of “lawyer,” you don’t need a marketing agency. That model works if you have the budget to sustain it.

But if you don’t, which is most firms in Texas, then you need a different strategy entirely. The Titans cast the widest net possible and process cases at volume. That means there are corridors they cover with generic ads instead of specific content, and niche case types they treat as one more file instead of a specialized claim worth building a campaign around. That’s where the opportunity is.

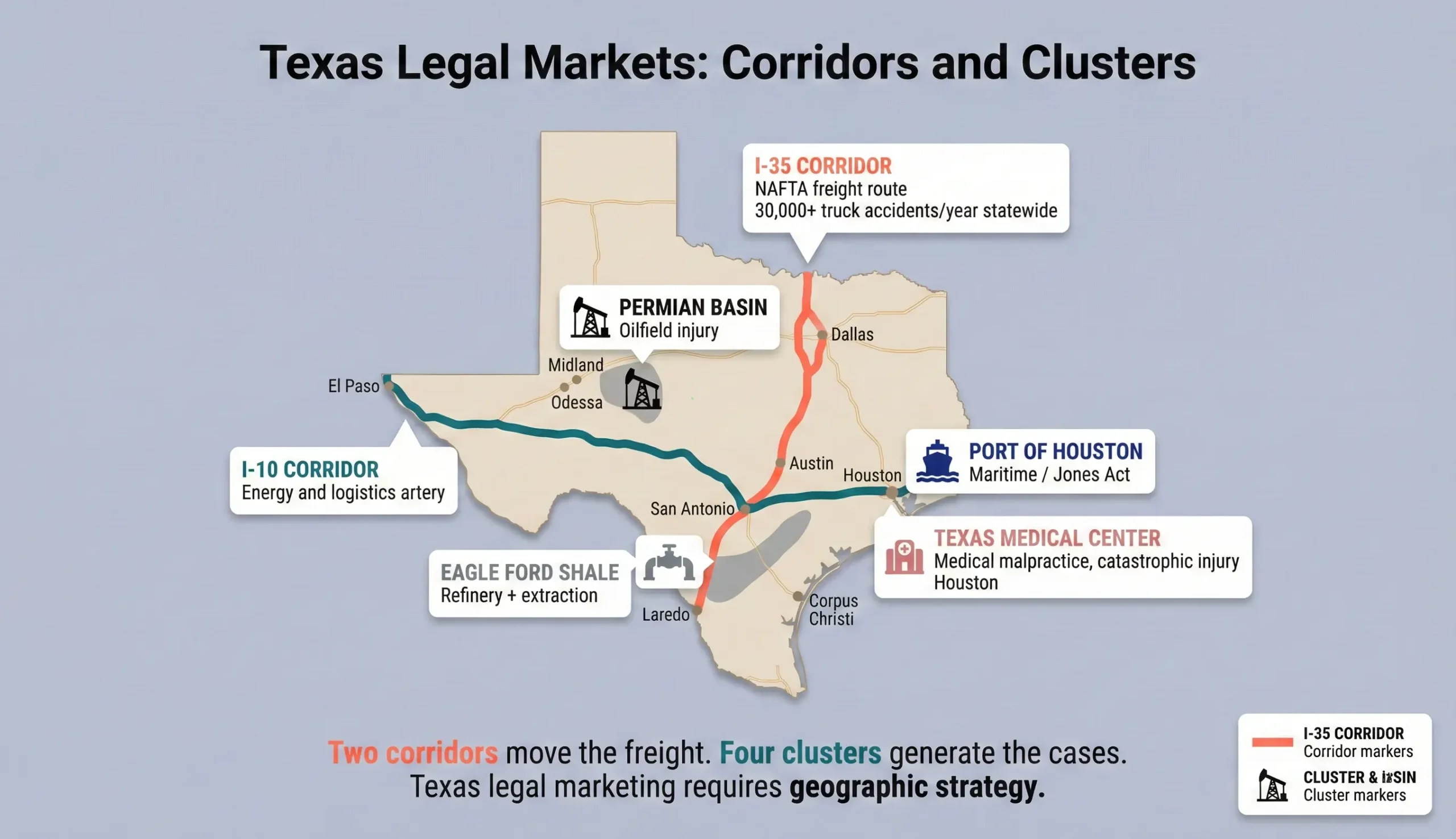

Texas has nearly 100,000 active attorneys, but 90% are concentrated in the four largest metros. The Rio Grande Valley has one attorney for every 805 residents. The Permian Basin generates oilfield injury cases that require technical content most general PI firms don’t produce. The I-35 corridor from Laredo to Dallas carries some of the heaviest freight traffic in the country. The Titans blanket the metros. The corridors and the niches are where smaller firms build practices.

The Corridors Where Cases Actually Happen

Texas personal injury isn’t just car accidents. The state’s economy generates case types that don’t exist at the same scale anywhere else.

The I-35 corridor from Laredo to Dallas carries NAFTA freight traffic that makes it one of the highest-volume trucking accident routes in the country. Firms that build content around specific intersections and counties along this corridor capture cases the metro-focused Titans miss because their landing pages don’t mention trucking.

The Permian Basin and Eagle Ford Shale generate oilfield injury claims that require specialized technical content. A page about “oilfield injury” that reads like generic PI doesn’t rank and doesn’t convert because the person searching knows their situation is different.

The Port of Houston creates Jones Act and maritime injury claims with per click costs exceeding $1,000. The case values justify it. Deep content and organic search rankings reduce the blended cost per lead compared to paid ads alone.

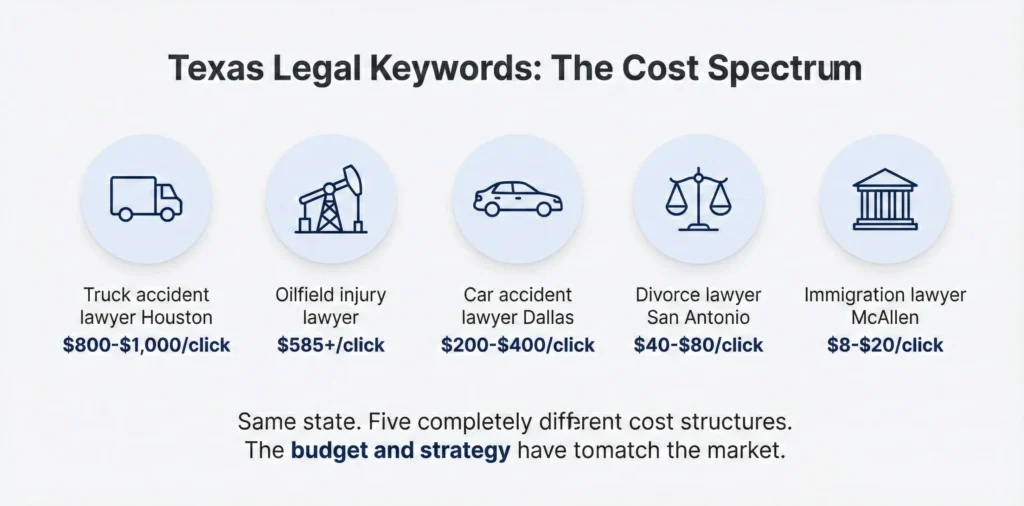

What a Click Costs in Texas

A single click on a trucking keyword in Houston can cost what an immigration firm in the Valley spends in a month. The case values are proportionally higher, but it means the budget has to be realistic for your market and the strategy precise enough that $800 clicks land on pages built for that exact case type.

In Houston and Dallas, firms spending under $10,000 a month on ads can’t compete on broad PI keywords. The strategy shifts to long-tail targeting: specific injury types, specific suburbs like Katy or The Woodlands, specific corridors. In San Antonio and the Valley, the same budget goes further but campaigns have to be bilingual.

Texas Practice Areas With Market Specific Dynamics

Personal injury in Texas operates in a pure tort system. No PIP threshold to clear. Every accident is a potential case from day one. The 51% comparative bar means marketing messaging can be more adversarial than in no fault states: “we fight the other driver’s insurance” instead of “we help you get your benefits.”

Medical malpractice was reshaped by HB 4’s $250,000 cap on non-economic damages. That cap made smaller cases unviable. Marketing targets catastrophic injuries where uncapped economic damages run into the millions: birth injuries, brain damage, paralysis.

Immigration splits into two different markets. The Valley and El Paso: removal defense, asylum, crisis driven. Austin and Dallas: H-1B visas, EB-5 investor visas, corporate compliance. Generic “immigration services” marketing speaks to neither.

Mass tort benefits from Harris County’s plaintiff-friendly courts. Houston attracts pharmaceutical and chemical exposure filings nationally. Local firms have a narrative advantage over national aggregators: “we’re the local firm fighting the company headquartered down the street.”

Family law in San Antonio involves military divorce. Joint Base San Antonio is the largest military installation in the country, and military divorce involves federal pension division rules that civilian divorce doesn’t. Marketing to this community requires military-specific content and trust signals.

Criminal defense has seasonal and geographic patterns. “No Refusal” weekends in Austin and San Antonio spike DUI searches around holidays and festivals. The I-35 corridor generates drug interdiction cases in the counties between San Antonio and Dallas. Campaigns that target these patterns capture cases at lower ad costs than firms running year-round generic campaigns.

Bankruptcy in Texas benefits from generous exemptions. The $190,000 homestead exemption and strong personal property protections drive searches like “can I keep my house in Texas bankruptcy.” This makes Texas favorable for debtors, which creates a content opportunity around exemption-specific questions.

Estate planning is growing alongside Texas’s wealth migration. No state income tax attracts high-net-worth retirees, and the $124 trillion generational wealth transfer drives demand for trust and succession planning. The Gulf Coast and Hill Country retiree communities need the same trust-first design that works in Florida’s senior markets.

Employment law targets oilfield overtime and misclassification. Texas is at-will, so wrongful termination claims are narrow. But the energy sector routinely misclassifies workers as independent contractors to avoid overtime, and federal wage law violation searches are high-intent keywords with strong case values.

What We Build for Texas Law Firms

Search rankings built around corridors and suburbs, not metros. “Houston personal injury lawyer” requires competing against decades of authority. “Katy truck accident attorney” is viable and converts better. In DFW, separate strategies for Dallas and Fort Worth because Google treats them as distinct entities.

AI search visibility answering Texas-specific legal questions with statute references. “What is the statute of limitations for a car accident in Texas?” “Can I sue if I’m partly at fault?” AI answers these directly now. If your content cites the specific Texas statute, your firm is the cited source. We structure every page with code that tells AI systems what your firm covers and where you practice.

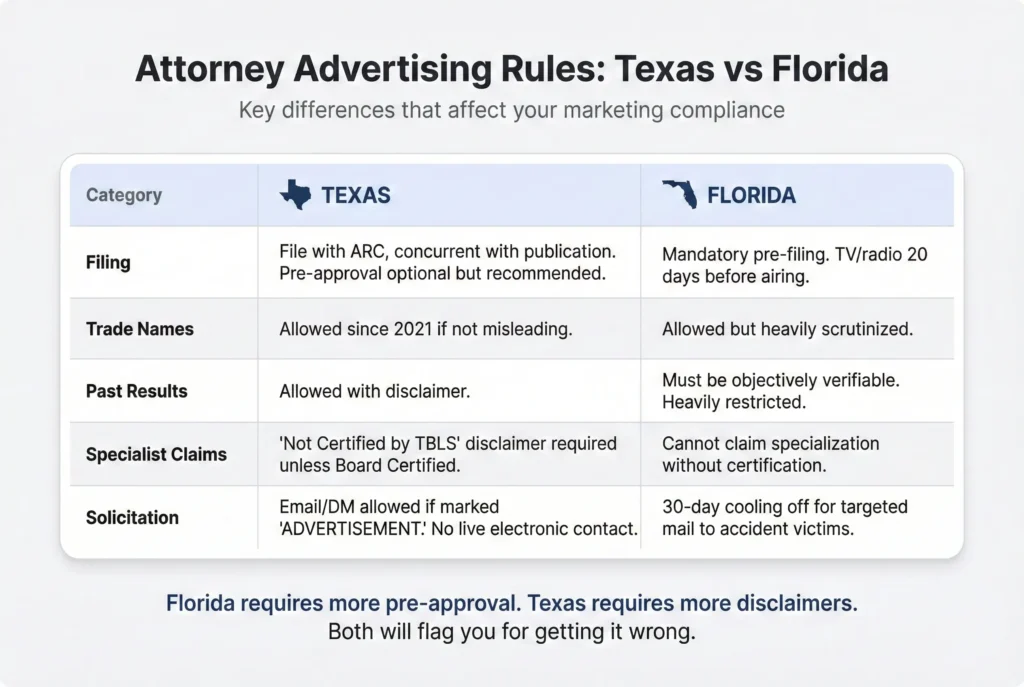

Bilingual campaigns across South and Central Texas. Forty percent of the Texas population is Hispanic. In San Antonio, Houston, and the Valley, Spanish-language campaigns aren’t optional. Culturally specific content in the relevant dialect, not a Google Translate toggle. Every bilingual page includes required Texas disclaimers in both languages.

Paid ads designed to survive the Titan auction. Long-tail targeting by injury type, corridor, and suburb instead of broad metro keywords. Local Services Ads with Google’s trust badge in every market. Conversion tracking showing actual cost per signed case, not just cost per click.

Review management that generates volume without violating Texas ethics rules. No incentives, no quid pro quo. Timing-based systems that request reviews after positive case resolution. And responses to negatives that don’t reveal case details. Review ethics by state →

Websites with required disclaimers built into the code. The “Not Certified by the Texas Board of Legal Specialization” disclaimer, the principal office location, and the contingency fee disclosure all have to be on the site and visible. We hard-code these into every page so compliance isn’t dependent on someone remembering to add them.

Texas Bar Rules That Affect Your Marketing

Texas updated its advertising rules in 2021. Trade names are now allowed. Email and DM solicitation is permitted if labeled “ADVERTISEMENT.” Filing with the Advertising Review Committee can happen the same day you publish.

But the disclaimers are non-negotiable. “Not Certified by the Texas Board of Legal Specialization” if you’re not Board Certified. Principal office city disclosed. Contingency fee terms spelled out. The Bar enforces these and competitors report violations.

How We Track Results in Texas

We track from first click to signed retainer, broken out by metro and by case type. Your Houston oilfield cases, your Dallas trucking cases, and your San Antonio family law cases each have their own cost per signed client, their own conversion rates, and their own ROI. A $1,000 click on a maritime keyword that converts to a seven-figure Jones Act case is a different calculation than a $40 click on a divorce keyword, and you can’t evaluate either without tracking the full path.

Full data ownership: website, hosting, analytics, ad accounts. You keep everything. What to look for in your reports →

Texas Markets We Serve

We work with law firms across every Texas metro and corridor. Houston, Dallas, Fort Worth, Austin, San Antonio, El Paso, McAllen, Corpus Christi, the Permian Basin, and everywhere along the I-35 and I-10 corridors. We also work with firms across the United States. Every campaign is built around the specific market’s costs, case types, and competitive dynamics. Tell us about your market →

Are you competing against the Titans on their terms, or building around the cases they’re too big to focus on?

Are you competing against the Titans on their terms, or building around the cases they’re too big to focus on?

Send me your current setup and I’ll show you whether your campaigns are targeting the corridors and niches where smaller firms actually win in Texas, whether your content covers the Texas-specific legal questions AI tools are answering right now, and whether your site includes all the disclaimers the Bar requires. If it’s already working, I’ll tell you.

Talk to Jorge → Phone or text: 941 626 9198