How do you calculate legal marketing ROI? The basic formula is (net profit from marketing minus marketing cost) divided by marketing cost, times 100. But most firms get this wrong because they use gross revenue instead of net profit, which inflates the number and hides whether the marketing is actually making money. For a quick operational check, use the revenue-to-cost ratio; divide gross revenue by total marketing cost. A 5:1 ratio is the minimum for a healthy campaign, 10:1 is outstanding. The metric that matters most for active campaign management is cost per signed case; total marketing spend divided by signed cases. Industry benchmarks for 2026 put that at $500 to $3,000 for PI, $250 to $750 for family law, and $200 to $1,000 for criminal defense.

Phone calls aren’t revenue. That sounds obvious but it’s the assumption buried inside most agency reports, where the ROI calculation stops at “we spent this much and the phones rang this many times” and everyone acts like the math is done. The actual number requires following the money from the ad click through intake, through the consultation, through the retainer, and in a contingency practice all the way to the settlement check that might not arrive for a year, which is a longer trail than most tracking systems are built to handle.

This is the math that connects the ad spend to the money that actually hits the bank account. Three formulas that matter, what the benchmarks look like by practice area, and why a firm spending $10,000 a month and signing cases might still be losing money if the cost per signed case is eating too much of the fee, which happens more often than anyone in this industry admits publicly.

The Three Formulas You Actually Need

What formulas should law firms use to measure marketing ROI? There are three. Standard ROI uses net profit: (net profit from cases minus marketing cost) divided by marketing cost, times 100. This is the most accurate but requires you to know your actual margins. Revenue-to-cost ratio is simpler: gross revenue divided by marketing cost. A 5:1 ratio means you’re generating $5 for every $1 spent, which is the minimum threshold after you account for overhead. Cost per signed case is the most actionable: total spend divided by signed cases. This tells you what you’re paying to acquire each new client, and it’s the number you should be checking weekly.

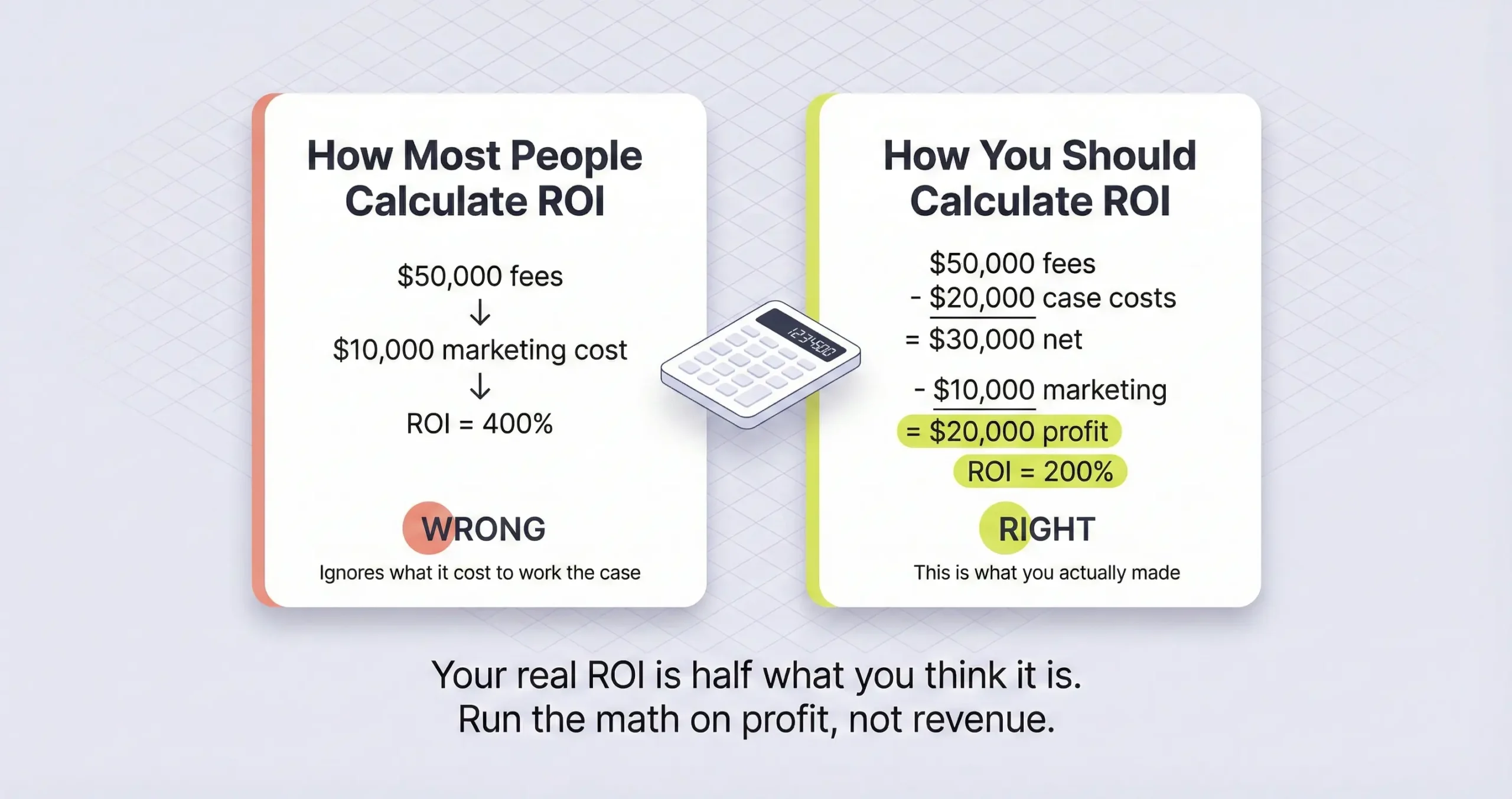

The standard ROI formula looks simple but the place where most firms mess it up is the “net profit” part. If a campaign generates $50,000 in gross legal fees and cost $10,000 to run, a lot of firms call that a 400% return and move on. But if the firm operates on a 40% margin after attorney time, overhead, and case costs, the net profit on that $50,000 is actually $30,000, which puts the real ROI at 200%. Still good, but half of what the first calculation suggested, and the difference matters when you’re deciding whether to scale the campaign.

The revenue-to-cost ratio is the one I use most for quick decisions because it doesn’t require you to calculate net profit on every case. You just divide what came in by what you spent. The benchmarks from the research are consistent; 5:1 is the floor, meaning for every dollar of marketing you should see at least five dollars back in gross revenue.

Below that and you’re probably breaking even or losing money once overhead is factored in. At 10:1 the marketing is producing real profit, and anything above 20:1 usually means you’re running on brand equity or referrals where the cost is low and the returns are high, which is great but not something you can replicate through paid campaigns.

Cost per signed case is the one that connects the marketing team to the intake team, and it’s the one we track most closely because it forces both sides to own the number together. If marketing generates cheap leads that intake can’t close, the cost per signed case spikes. If intake is great but the leads are expensive, same thing. It’s the equilibrium metric for the whole system.

Why 82% of Firms Think Paid Search Doesn’t Work

Why do most law firms think paid search ROI doesn’t justify the spend? Research shows 82% of firms using paid search don’t think the ROI justifies the cost, yet 78% keep doing it. The problem isn’t that paid search doesn’t work, it’s that most firms can’t connect the ad spend to the signed case. They see the bill but can’t trace which cases came from that spend. Without that connection, paid search feels like a tax instead of an investment, and the rising cost of legal keywords; some exceeding $1,000 per click; makes the anxiety worse. Firms that solve the tracking problem usually find that their paid search was working better than they thought.

This number stuck with me when I first saw it because it describes exactly what I felt at Percy for a long time. We were spending money on Google Ads and the phones were ringing but I couldn’t tell the partners with confidence which signed cases came from the ads and which came from the billboard or the referral network or just the firm’s name recognition, and without that connection it felt like we were just hoping the ads were doing something.

The three reasons this happens are consistent. First, legal keywords are expensive and a few bad clicks feel catastrophic when you’re spending $2,000 a month and a single click costs $150. Second, most firms outsource the ads but don’t have the internal tracking to verify the agency’s report, so they see the cost without seeing the revenue.

And third, a lot of firms view paid search as defensive; they bid on their own name or their practice area not because they expect growth but because they’re afraid a competitor will take that spot, and spending money out of fear doesn’t feel like an investment.

The firms that get past this are the ones that close the tracking loop. Once you can show a managing partner that a $15,000 Google Ads spend produced 3 signed PI cases worth a projected $450,000 in settlements, the conversation about ROI stops being abstract, and the 82% drops to zero inside that firm because the math is visible.

How the Math Changes by Practice Area

What are good marketing ROI benchmarks by legal practice area? PI firms should target a cost per signed case of $500 to $3,000 depending on case type and market competition, but ROI takes a year or more to realize because of settlement timelines. Family law should target $250 to $750 with ROI measured in retainers collected within weeks. Criminal defense targets $200 to $1,000 with the fastest cash-on-cash return because clients hire immediately. Estate planning targets under $300 but the real value is lifetime referrals and inter-generational work. The marketing spend as a percentage of revenue also varies; PI firms often spend 15 to 20% because the case values justify the acquisition cost, while estate planning firms spend 2 to 5%.

The thing I didn’t understand early on is that a “good” cost per signed case for one practice area is a disaster for another. When I was at Percy running PI campaigns, a $2,000 cost per signed case was fine because the average case value was 10 or 20 times that. But if you applied that same cost to a traffic ticket practice where the fee is $300, you’d be bankrupt in a month.

PI and mass tort are the hardest to measure because the revenue is delayed. You sign the case today and the settlement comes in 12 to 18 months later, sometimes longer. That gap is where most of the measurement anxiety lives because you’re spending real money now and the return is theoretical until the check clears.

The solution is pipeline value forecasting, which just means assigning an estimated case value when the retainer is signed based on historical averages for that case type, and using that projected number to calculate interim ROI while you wait for actual settlements. It’s not perfect but it’s better than flying blind for 18 months, which is what I did at Percy before I figured this out.

Family law and criminal defense are easier to measure because the retainer gets collected within weeks of signing. The cash-on-cash return is fast, which means you can evaluate a campaign in 60 to 90 days instead of waiting a year. The trade-off is that the per-case value is lower, so your cost per signed case ceiling is much tighter. A PI firm can afford to pay $3,000 to acquire a case worth $100,000. A criminal defense attorney can’t pay $3,000 to acquire a $2,500 DUI retainer, and the Google Ads ROI math changes at that level.

When Spending More Stops Working

Why does marketing ROI decline when you increase the budget? Diminishing returns. The first $10,000 of ad spend captures the people most likely to hire you; high intent, ready to sign. The next $10,000 reaches people who are less ready, more expensive to convert. If you double your Facebook budget from $10,000 to $20,000 and revenue only goes up 20%, your ROI just dropped from 5:1 to 3:1. The fix isn’t to keep spending more on the same channel, it’s to move the incremental budget to a different channel or geographic market where the cost of acquiring the next client is still low.

I think this is the part that gets firms into trouble because they have a campaign that works at one budget level and they assume it’ll work the same way at double the budget, and it almost never does. The audience you can reach with $10,000 is not the same audience you reach with the second $10,000; the first batch was the low-hanging fruit and the second batch is harder to convert.

The research calls this the “pivot” strategy and the idea is that instead of pouring more money into a saturating channel, you shift the incremental spend to wherever the next cheapest conversion is. Maybe your Google Ads are producing well at $10,000 but saturating, so you put the next $5,000 into LSAs where the conversion rate is higher. Or you shift to a new geographic market where competition is lower. The point is to maintain a high aggregate ROI by constantly chasing the most efficient incremental conversion instead of brute-forcing one channel past the point of diminishing returns.

At Percy we learned this by accident. We increased the PPC budget one quarter thinking more spend would mean proportionally more cases and the numbers didn’t track. The cost per signed case went up by maybe 40% while the case volume only went up 15%, and it took us a few weeks of looking at the data to realize we’d saturated the easy audience and were now paying premium prices for the harder-to-reach people, which is a lesson I probably should have learned sooner but here we are.

What to Actually Track and How Often

How often should law firms measure marketing ROI? Weekly for cost per signed case and lead-to-sign conversion rate. Monthly for revenue-to-cost ratio and channel comparison. Quarterly for true ROI including net profit and pipeline value forecasting for contingency cases. If your practice management software tracks lead source (like MyCase’s Leads Referral Source report), use it to see not just how many leads came from each channel but how many signed and how much revenue they generated. Without that source attribution, you’re measuring activity, not results.

The minimum I’d recommend is knowing your cost per signed case by channel every week. Not cost per lead; cost per signed case. If you only track cost per lead you end up in the trap where the agency reports look great and the bank account doesn’t match, because leads and revenue are different things and the gap between them is where most of the money gets lost.

Whatever case management system you use; MyCase, Clio, Filevine; the key is that your intake team marks the lead source when the contact comes in and updates the status when the retainer gets signed. If that data entry doesn’t happen, no formula in this post works because you can’t attribute revenue to a channel without knowing where the lead came from.

At Percy we messed this up for a long time because the intake person would mark the source as “website” for everything, which told us nothing about whether the lead came from SEO, Google Ads, or a Facebook campaign, and until we fixed that our ROI calculations were basically guesses.

For contingency firms where the revenue is delayed, I’d add a quarterly pipeline review where you look at projected case values for signed cases and calculate a provisional ROI to see whether your current campaigns are heading in the right direction, even if the settlements haven’t come in yet. It’s not a final answer but it keeps you from making budget decisions based on data that’s 18 months old, which is what happens when you wait for actual collected fees to run the ROI math.

Not sure what your marketing is actually returning?

Send me your last 90 days of spend by channel and how many cases signed from each. I’ll run the formulas and tell you where the ROI is strong and where it’s leaking. If the numbers are already good I’ll say so.