What does Argota Marketing do for bankruptcy law firms? Argota builds bankruptcy marketing campaigns around how people actually behave when they’re considering filing. They don’t search once and call. They research for weeks, sometimes months, reading about Chapter 7 and Chapter 13 and exemptions before they’re ready to talk to anyone. We build the search rankings, the AI visibility, the paid ads, the website, and the review profile to be present during that entire research window, so when they’re finally ready to pick up the phone, your firm is the one they’ve been reading the whole time. We run separate campaigns for Chapter 7, Chapter 13, and business reorganization because they’re different clients searching different things.

Bankruptcy Clients Take Longer to Call Than Any Other Practice Area

Someone considering bankruptcy doesn’t search for a lawyer and call the same day. They search “what happens if I file Chapter 7” at 11 PM, read three articles, close the browser, and come back two days later with a different question. They do this for weeks. They compare Chapter 7 to Chapter 13. They look up whether they can keep their car, their house, their tax refund. They read about the means test. They check what it costs. Eventually they start reading reviews of actual firms in their area, and only then do they pick up the phone.

That research window is your entire marketing opportunity. If your firm’s content is what they’re reading during those weeks, your name is already familiar by the time they’re ready to call. If your content only shows up when someone searches “bankruptcy lawyer near me,” you’re competing for the last click in a process that started a month earlier, and you’re paying the highest ad rates to do it.

Bankruptcy filings hit 565,000 in 2025, up 11% from the year before. Chapter 7 filings alone rose 15%. The demand is growing. The question is whether your marketing is present during the research that happens before someone decides to file, or only after.

What We Build for Bankruptcy Firms

Search rankings and content covering the questions people ask for weeks before they call. “Can I keep my house?” “What’s the difference between Chapter 7 and 13?” “Will bankruptcy affect my credit forever?” “What are the exemptions in my state?” AI tools now answer these directly, and if your firm’s content is the source the AI quotes, your name appears in every answer they read during those weeks of research. We build your site as a deep, interconnected set of pages that covers the full scope of bankruptcy questions in your state so that Google and AI tools treat your firm as the authority. How we build search campaigns →

AI search visibility so your firm gets cited in the answers people read before they’re ready to call. When someone asks ChatGPT “what happens to my 401k if I file bankruptcy,” the AI builds an answer from sources it trusts. We structure your content and add code to your site that tells AI systems what your firm covers and who your attorneys are, so your firm is the one getting cited. In bankruptcy, where people research for weeks through AI tools before making a decision, being the cited source across multiple questions builds familiarity that no single ad can match. AI search for law firms → / AI strategy →

Paid ads for when they’re finally ready to call. Local Services Ads with Google’s trust badge capture the moment someone moves from research to action. The trust badge matters more in bankruptcy than almost any other practice area because people filing are already anxious about being taken advantage of, and a verified credential from Google helps. We also run retargeting campaigns that keep your firm visible to people who visited your site during their research but weren’t ready to call yet. In bankruptcy, retargeting isn’t optional because the decision cycle is so long that without it, someone reads your content for three weeks and then calls the firm whose ad they happened to see on the day they were finally ready.

Review management where the words in the reviews matter as much as the rating. Bankruptcy clients reading reviews aren’t just looking at stars. They’re looking for specific words: “non-judgmental,” “explained everything,” “made it less scary,” “treated me like a person.” We manage your review profile with automated systems that request reviews from clients at the right moment, usually right after discharge when the relief is fresh, and we respond to negative reviews using bar-compliant language that protects your reputation without revealing anything about any case.

Chapter 7, Chapter 13, and Business Clients Need Different Campaigns

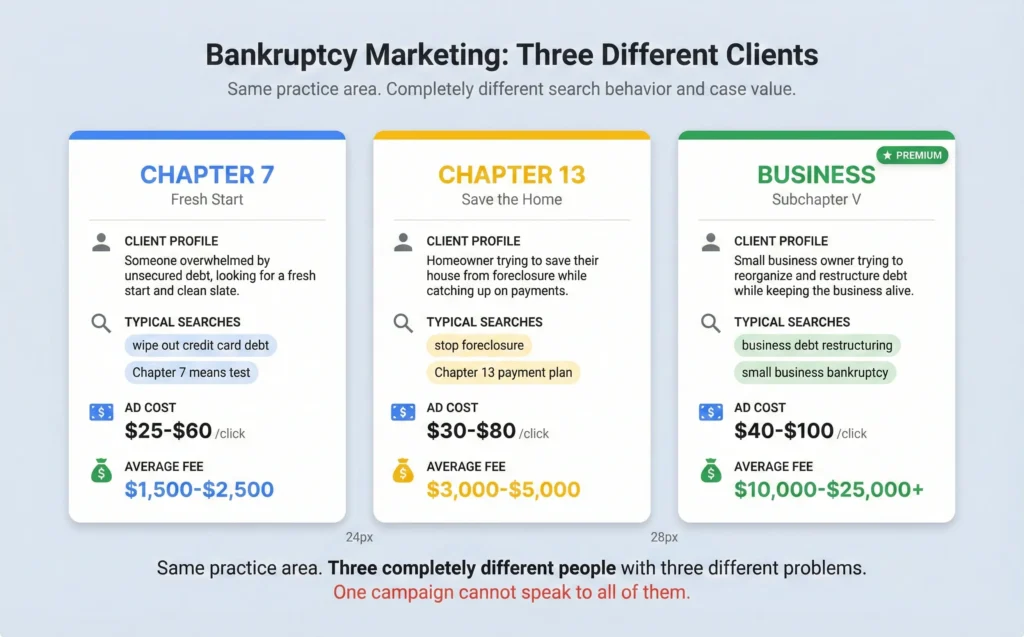

A Chapter 7 client and a business owner considering Subchapter V reorganization are not the same person, and running the same ads for both wastes money on each. The Chapter 7 client is searching for relief from personal debt and needs to know they qualify under the means test. The Chapter 13 client is usually trying to save a house and needs to understand the repayment plan. The business client is trying to keep their company alive and needs to know there’s a path that doesn’t mean closing the doors.

We build separate campaigns for each. Chapter 7 targets the high-volume personal debt searches where speed and simplicity are the message. Chapter 13 targets homeowners facing foreclosure where asset protection is the message. Business reorganization targets the much smaller but higher-value pool of business owners where the message is that restructuring exists and works. Subchapter V elections jumped 11% last year and spiked 36% in December alone, which means more business owners are discovering this option and searching for it.

Why the Website Tone Matters More Here

Someone visiting your website is probably stressed, probably embarrassed, and probably worried about being judged. A site full of aggressive language about “fighting creditors” and “winning your case” reads like it was designed for a different practice area. Bankruptcy clients aren’t looking for a fighter. They’re looking for someone who will explain what happens next without making them feel worse about the situation they’re already in.

We build bankruptcy websites around that emotional reality. Clean design, calm colors, short sections, plain language. The phone number is always one tap away on mobile. The intake form asks the minimum needed to start a conversation: name, phone, and whether the situation is urgent. Every extra field you add costs you conversions because someone who’s already reluctant to reach out will use any friction as a reason to close the tab. And the site meets federal accessibility standards, which matters both for compliance and because Google rewards accessible sites with better visibility.

How We Track Results

Bankruptcy marketing has solid economics when the campaigns target the right chapter type. A single Chapter 7 case generates $1,500 to $2,500 in fees. Chapter 13 generates $3,000 to $5,000. Business reorganizations generate $10,000 to $25,000 or more. Even with ad costs running $25 to $100 per click, the math works when the campaigns separate the chapter types and the website converts the traffic.

We track from first visit through signed retainer, broken out by chapter type and by how many weeks between first visit and phone call. That research window data tells you whether your content is doing the work of building familiarity before the call, or whether you’re losing people during the weeks between their first search and their decision. Full data ownership: website, hosting, analytics, ad accounts. You keep everything. Cost per signed client →

What to look for in marketing reports →

Bankruptcy Marketing by State

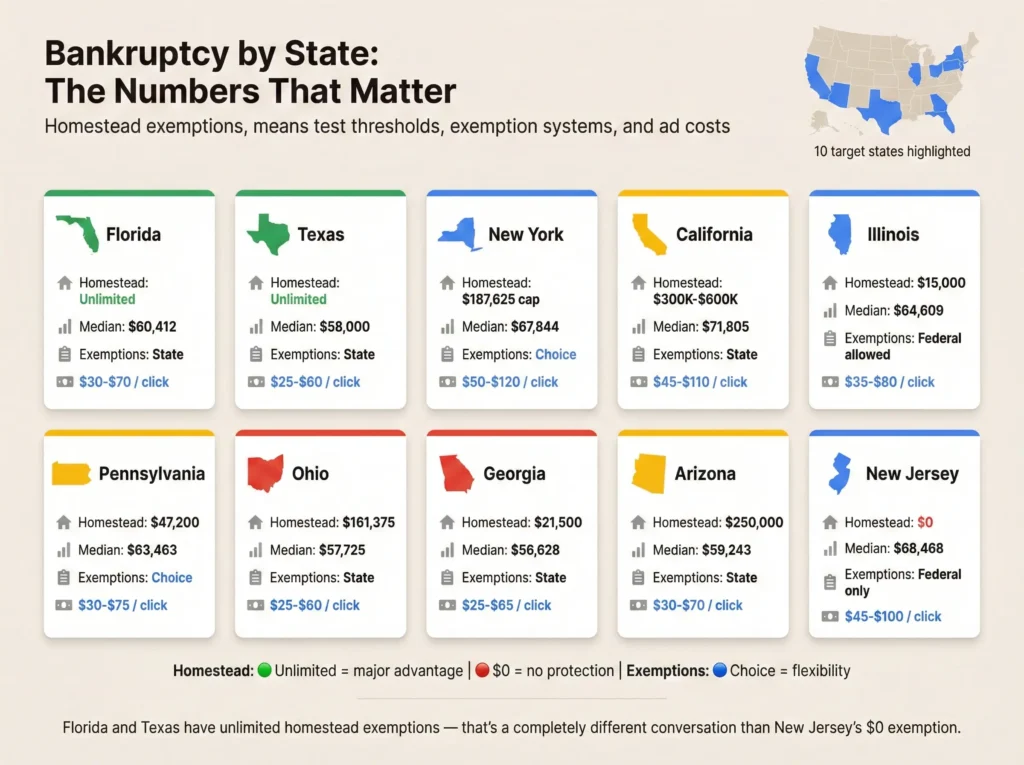

Bankruptcy law is federal but the exemptions are state-specific, and that changes what people search for and what your content needs to cover. Whether your state has an unlimited homestead exemption or a $25,000 cap changes the entire conversation for homeowners. Whether your state uses federal or state exemptions affects the strategy for every client. And ad costs in New York are three times what they are in Ohio.

Florida · Texas · California · New York · Illinois · Pennsylvania · Ohio · Georgia · North Carolina · New Jersey

Don’t see your state? We work with bankruptcy firms nationwide. Tell us about your market and we’ll build around your state’s exemptions and competitive landscape.

Are you visible during the weeks before they call, or just the day they’re ready?

Send me your current setup and I’ll show you whether your content is appearing in the searches people make during those weeks of research, whether your paid ads include retargeting for the people who visited and weren’t ready yet, and whether your site is designed for someone who needs reassurance before they need a sales pitch. If it’s already working, I’ll tell you.

Talk to Jorge → Phone or text: 941 626 9198