In a car accident case the intake call is basically the whole qualification. You confirm the accident happened, there’s insurance, there’s treatment, and the case moves forward. Mass tort doesn’t work like that. The retainer is just permission to start investigating, and the investigation is where the real money gets spent; ordering medical records, hiring nurse reviewers, tracking down product lot numbers, running the case through criteria that might disqualify 60 to 70% of the people who signed. The gap between “signed retainer” and “filed lawsuit” is where most mass tort marketing budgets actually go to die, and it’s the part that never shows up on the agency’s monthly report.

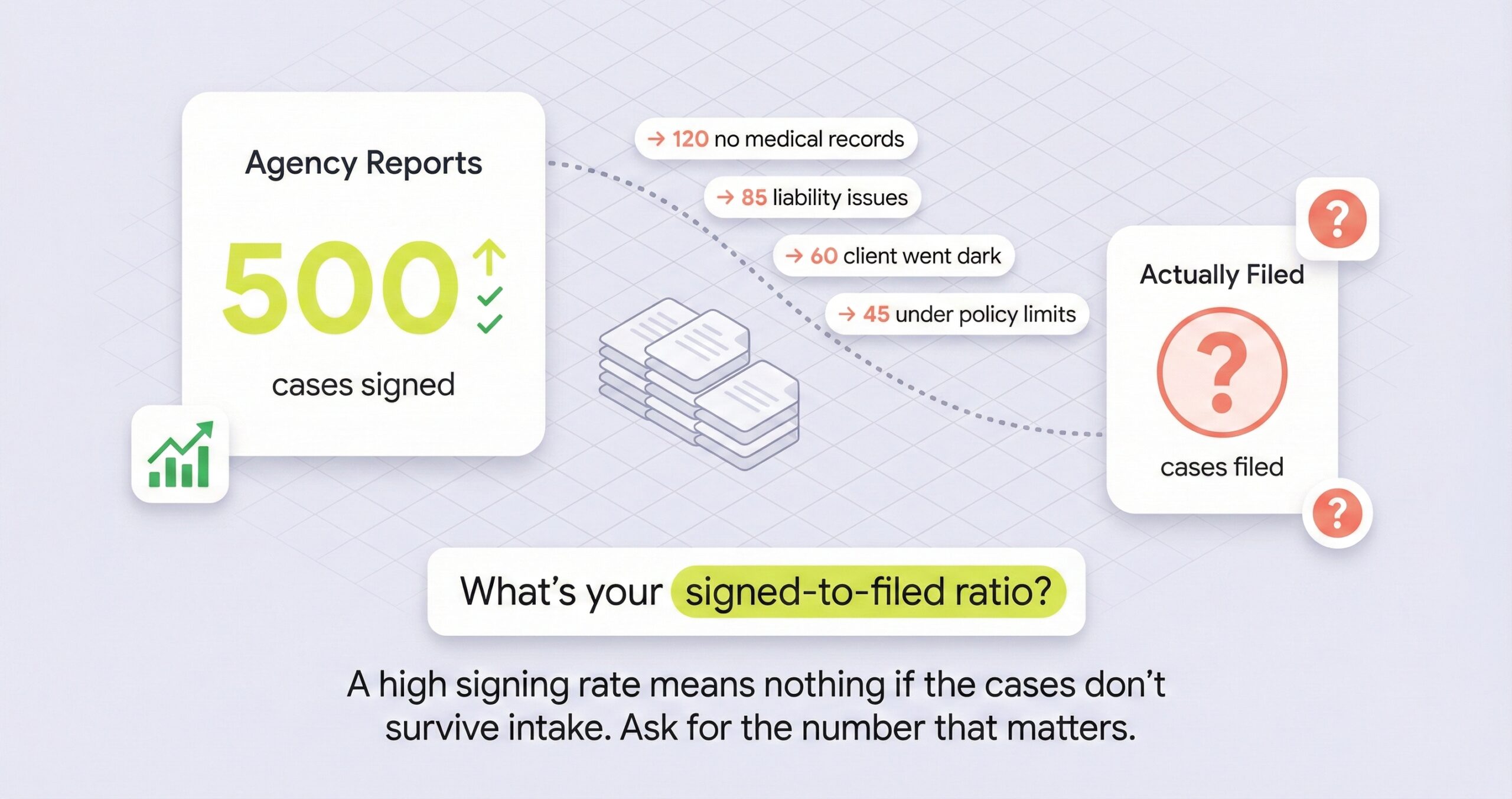

Which means cost per signed case, the number that works as the bottom line metric for most practice areas, doesn’t tell you enough in mass tort. A firm could sign 500 cases from a Zantac campaign at $200 each and feel great about it until the medical review knocks out 400 of them and the real cost per viable case is $1,000, plus whatever was spent reviewing the 400 that didn’t qualify. The metric that matters here is cost per filed case, and if your tracking stops at the retainer you’re making budget decisions based on a number that hasn’t been filtered through the part of the process where most of the waste happens.

Why So Many Signed Retainers Never Get Filed

Why do so many signed mass tort cases never get filed? Because the retainer only authorizes the firm to investigate. The actual case depends on confirming the specific product was used, the specific injury matches the litigation criteria, medical records exist to prove it, and no other firm already represents the same person. Roughly 40% of signed mass tort retainers fail one of those checks. In single-event cases like car accidents the failure points are mostly at intake; wrong practice area, no insurance, statute expired. In mass tort the failure points come weeks or months after signing, which means you’ve already spent money on records retrieval, staff time, and filing preparation before you find out the case is dead.

In a car accident case, the proof exists on day one; police report, photos, ER records. In mass tort, the claimant might be describing a medication they took for 8 years that they stopped 3 years ago and a cancer diagnosis from last year, and confirming all of that requires pulling records from multiple providers, sometimes providers that closed or merged, and having a nurse review thousands of pages to find the entries that confirm or deny the claim.

The industry data on this is kind of brutal. The research puts the fallout rate at roughly 40%, and it breaks down into a few categories; wrong diagnosis, can’t prove product use long enough to meet settlement criteria, duplicate representation where the person already signed with another firm, or the claimant just stops responding. Every one of those cases still cost money in records retrieval, staff time, and case management before it got closed out, and that cost is invisible on the marketing dashboard because it happens downstream from the lead.

The Costs That Accumulate on Dead Cases

What are carrying costs in mass tort cases? Every open file in your system costs money whether the case is real or not. Medical record retrieval runs $30 to $100 per request. Federal filing fees are around $400 per case. Case managers spend hours on monthly touchpoints to keep claimants responsive. If 30% of your signed cases turn out to be unqualified, you’ve spent thousands on records, filing prep, and staff time for files that will never produce a dollar. These are carrying costs, and in mass tort they accumulate fast because the timeline between signing and resolution can be 3 to 5 years.

The thing that makes this different from a car accident case is the timeline. A bad lead on a single-event case costs you maybe 12 minutes of intake time and you move on. A bad mass tort case might sit in your system for 6 months before anyone figures out it’s dead, and during those months you’ve paid for records, assigned a case manager, maybe paid for a nurse review, and now you’re writing it all off.

The industry calls them “zombie cases” and from what I can tell it’s a real problem at scale; files that aren’t alive and aren’t dead, just sitting there using resources. At Percy we had the same issue with stale single-event cases lingering in the system because nobody had time to close them out, except in mass tort the carrying cost per dead case is way higher because of the records and review expenses, and it adds up in ways that don’t show on anyone’s dashboard.

Why Signing Fast Can Actually Hurt You

Should mass tort firms sign cases as quickly as possible? No, and this is where mass tort diverges most from single-event PI work. In a car accident case, speed wins because if you don’t sign the victim in 5 minutes another firm will. In mass tort, signing too fast without vetting creates problems that cost more than losing the lead would have. The biggest risk is dual representation, where a claimant clicks 3 different ads on the same platform, signs with multiple firms through instant e-sign tools, and nobody catches it until filing. You do the work, pull the records, prepare the filing, and then find out another firm already filed for the same person. Your recovery is zero.

The speed-to-sign mentality from single-event cases doesn’t translate because the competitive dynamics are different. In a car accident there’s one victim and multiple firms racing to sign them, and the lead sourcing model matters because shared leads amplify that race. In mass tort there are potentially thousands of claimants exposed to the same product, and the race isn’t to sign them first, it’s to file them with the right evidence before the court’s deadline.

I don’t have a perfect answer on how long the verification hold should be, but the research suggests that even a short delay for a duplicate check, product identification, and basic injury screening before the retainer goes out can move filing rates from the 50s into the 80s percentage-wise, and on a docket of 500 cases that’s the difference between 250 and 400 that actually make it to court.

What Changed in December 2025

How does Rule 16.1 affect mass tort lead quality? Federal Rule of Civil Procedure 16.1, effective December 2025, requires early exchange of information about the factual basis of claims. Before this rule, firms could file thousands of thinly vetted complaints and fix problems later. Now courts are requiring specific threshold evidence at or near filing; proof of product use, proof of specific injury type, sometimes proof of specific product brand. This means lead quality isn’t just about whether a person wants to sue, it’s about whether they have the evidence to sue right now. A lead that can’t produce proof of use within 30 days is now a liability rather than an asset.

This is the part I think matters most going forward and most marketing teams haven’t caught up to it yet. Before December 2025, the strategy was basically sign everyone who qualifies on paper and figure out the evidence later, and firms could park thousands of cases in the system while they worked through records retrieval at whatever pace they could manage.

Now the courts are saying show me the evidence early or the case gets dismissed, and some of those dismissals are permanent. For a firm that measures success by signed retainers without tracking the evidence behind them, the dashboard still looks healthy but the court is asking how many can produce a completed fact sheet with verified data, and if the answer is less than half then the rest are heading toward dismissal and all the money spent on them is gone.

What Should Actually Be Measured

What metrics should mass tort firms use instead of cost per lead? The most important number is your filing rate; how many signed retainers actually make it to court. If you sign 100 and file 60, that 40% drop-off represents wasted investigation costs on every one of those 40 cases. Beyond that, track your medical record retrieval rate (what percentage of requests actually produce records), your positive review rate (what percentage of retrieved records confirm the qualifying injury and product use), and your dual representation rate (what percentage of signed claimants already have another attorney). These downstream numbers tell you whether your leads are real cases or expensive paperwork.

The mistake I see most often is measuring the top of the funnel and ignoring the bottom. Cheap leads with broad targeting flood the intake queue with people who used the product but don’t have the right injury, or have the right injury but can’t prove they used the right product.

The cost of screening all those people through records retrieval adds up fast, and a lead source at $50 per lead with a 40% filing rate might cost more per filed case than a source at $500 with a 90% filing rate, and you can’t see that if you’re only tracking cost per lead.

The other thing worth measuring is how close your average claimant matches the cases that have settled at the highest tier. In mass tort your cases aren’t valued individually like a car accident settlement; they’re slotted into tiers based on injury severity, product usage duration, and evidence quality. If most of your signed cases land in the lowest tier where payouts are minimal, your docket looks impressive but the revenue won’t match, and I think that disconnect is what causes the overwhelm most mass tort partners describe.

Not sure what your leads are actually costing per filed case?

Send me your last 90 days of mass tort intake data and I’ll calculate the real numbers; filing rate, fallout points, and where the leakage is. If your vendor’s leads are performing I’ll tell you. If they’re not, you’ll have the data to figure out what to do next.