Should a PI firm prioritize lead volume or lead quality? Quality, and it’s not close. Exclusive leads where your firm is the only one calling convert at roughly 10%; 1 in 10 becomes a signed case. Shared leads that get sold to 3 to 5 firms convert closer to 2.5% because the caller’s phone is already ringing from other offices. You need 40 shared leads to match what 10 exclusive leads produce, and the shared ones end up costing more per signed case even though each individual lead is cheaper. When you add what it costs to staff a team that processes 40 contacts per case versus 10, the “cheap” option stops making financial sense pretty fast.

Two PI firms in South Florida, both spending roughly the same monthly budget, and I was looking at their numbers side by side maybe five months ago because one of them called me frustrated and the other called wanting to grow what was already working.

The frustrated firm was buying leads at about $100 each from one of those aggregator sites and pulling in 300 or 400 contacts a month, and their intake people were drowning in calls that went nowhere. The other firm was paying $350 per lead from a source that didn’t sell to anyone else, getting maybe 40 contacts a month, and their office felt like a different planet.

Both firms were signing roughly the same number of cases, which is the part the managing partner at the first firm couldn’t wrap his head around. He was like “I’m getting ten times the leads and we’re not signing ten times the cases” and I was like “yeah because most of what you’re paying for isn’t real” and it took a couple hours with their actual numbers to show him where it all went, but once he saw it he couldn’t unsee it.

Why 10% and 2.5% Are Two Different Businesses

What is the conversion rate difference between exclusive and shared PI leads? Exclusive leads where only your firm gets the contact convert at roughly 10%; about 1 in 10 signs. Shared leads sold to 3 to 5 firms land closer to 2.5% because you’re splitting whatever conversion potential exists across every office that received the same person’s info. Signing one case from shared leads means buying and processing about 40 contacts. Signing one from exclusive means about 10.

So the gap isn’t because shared leads are bad people or fake accidents or whatever. A lot of times it’s the same type of caller with the same type of wreck, but when someone fills out a request on an aggregator portal their phone starts blowing up from 3 or 4 or 5 different law offices within like 90 seconds and whoever picks up first gets the only real shot.

Even if your intake person is fast, you’re winning that race maybe 1 out of 4 times, and 10% split across 4 firms is 2.5%, which isn’t bad marketing or bad luck; it’s just division. I don’t know exactly why the industry defaults to shared when the math is this straightforward but I think it’s because $100 per lead looks better on a spreadsheet than $350 and most people never calculate past that first number.

Nobody else is calling on an exclusive lead, so your person on the phone can slow down, listen, maybe show some warmth, and the caller isn’t being yanked in 4 directions at once which means they’re actually present for the conversation instead of half out the door already. That difference in how the call feels is a huge part of why the sign rate holds at 10% instead of cratering, and it’s something the spreadsheet doesn’t capture at all.

Which brings up the money part, because the conversion gap is only half the story and the other half is what happens inside your office when you’re processing 40 contacts for every one case versus 10.

What It Really Costs When You Count the Hours

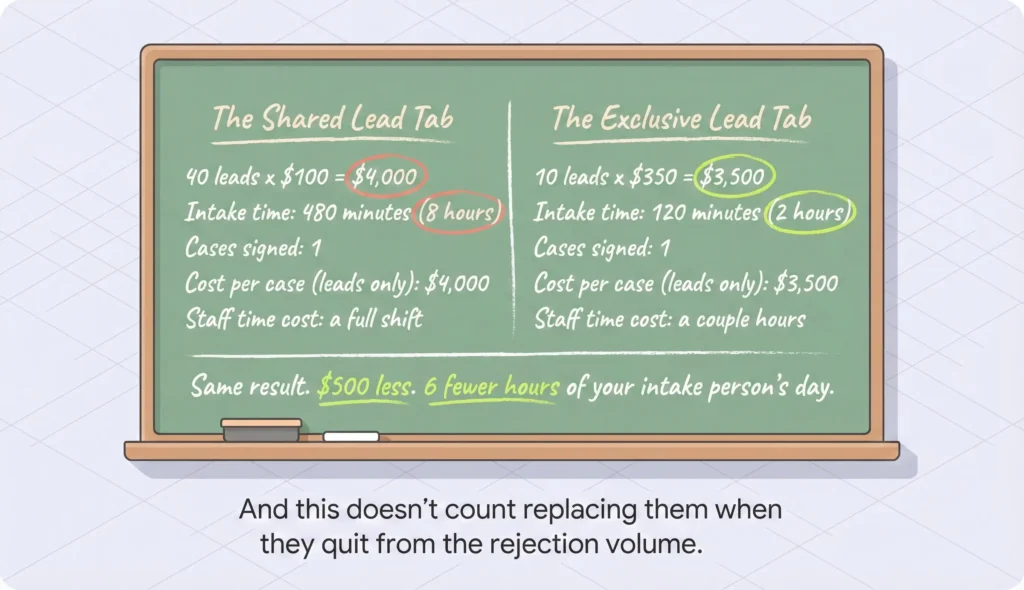

Do cheap shared PI leads actually cost more per signed case? Usually. Shared leads at $100 each require about 40 contacts to sign one case, so your lead cost per case is $4,000. Exclusive leads at $350 each need about 10, putting you at $3,500. The “expensive” leads are already $500 cheaper per signed case before you count staffing. Each contact takes your intake person maybe 12 minutes between call attempts, voicemails, texts, and notes. Processing 40 shared leads burns a full 8 hour shift. Processing 10 exclusive leads takes about 2 hours.

If every contact eats about 12 minutes of intake time, which is conservative once you count the voicemails and callbacks and texts and logging everything, then 40 shared leads is 480 minutes and that’s a full 8 hour day of someone’s life for one signed case. Ten exclusive leads at 12 minutes each is 120 minutes, two hours, same case.

So those 30 contacts out of 40 that didn’t become anything; the wrong numbers, the people who already hired someone, the ones outside your jurisdiction, the person who just wanted to know if their bumper was covered or something. Every one of those still ate 12 minutes.

Your intake coordinator still left a voicemail, sent a text, logged a note, tried again the next morning, then marked it dead. That labor is invisible on the dashboard your vendor sends you but it’s real money leaving your firm every month and it adds up to something wild when you actually sit down with the numbers.

When PI firms tell me they buy shared leads to save money I ask them to pull their last 90 days and calculate what they actually paid per signed case with the intake hours included and they almost never have, and once they do the conversation shifts pretty fast because the savings they thought they had aren’t there.

But the labor cost is only the part you can measure. The part you can’t measure as easily is what happens to the people doing that labor when 97 out of 100 calls go nowhere, because that’s where the real expense hides.

What Junk Volume Does to the People Answering Your Phone

How does lead quality affect intake staff at PI firms? When most of the calls coming in are dead ends, your intake team stops expecting any given call to be real. They rush screening, go emotionally flat, and when a case does come through they sometimes fumble it because they’ve been in rejection mode all morning. Turnover follows. Replacing a trained intake person runs between a third and double their salary when you count recruiting, training, and the cases that slip through while the new person gets up to speed. Some estimates put that past $200,000 including lost revenue.

Look, nobody wants to talk about this because it sounds soft compared to the math, but it might be the most expensive problem in the whole equation and most firms don’t track it at all.

If you’re running 300 or 400 contacts through intake every month and signing maybe 10 cases, your people hear “no” roughly 97 times for every 3 times something works out. That ratio changes a person after a few months. They start assuming the next call is junk before they’ve even picked up, and the screening gets sloppy, and when a real case does ring in they’re so checked out from the last 30 rejections that they miss something or rush through it or just sound tired.

The firm then spends two months recruiting, another month training, and during that whole stretch the phones aren’t covered the way they need to be and cases walk to whoever else picked up, and I’ve watched firms go through this cycle two or three times in a year without ever connecting the turnover back to the lead model that caused it, which I still find sort of baffling.

Firms buying exclusive leads have intake teams talking to maybe 10 or 15 contacts a day where more of those conversations actually go somewhere, and the person doing that job feels like they’re helping people instead of dialing into a wall for 8 hours, and those people stick around and get better at it over time instead of burning out and restarting the cycle every six months or whatever.

Why the Volume Pitch Keeps Working on Firms That Should Know Better

Why do PI firms keep buying cheap shared leads? Because “300 leads a month at $100 each” sounds like momentum. The phones ring, the CRM fills up, the team looks busy, and the managing partner sees activity everywhere and assumes the machine is running. But a phone ringing 300 times with 290 dead ends costs more and wears out more people than one ringing 40 times where 30 of those are real conversations with people who need a lawyer.

I think the growth-focused managing partner gets caught here because their instinct is to scale by adding volume; more inputs, more outputs, and in most businesses that works. But PI breaks the pattern because processing a junk contact costs almost as much as processing a good one and you don’t know which is which until 12 minutes in.

So the firm gets 300 leads, hires 3 or 4 people to handle it, signs 8 cases, and the partner looks at all that noise and goes “we need more leads” when what they need is fewer, better leads that nobody else is calling on. I’ve had that conversation probably a dozen times and it always starts with the partner being skeptical that less volume could produce the same revenue, which honestly is fair because it sounds wrong until you see the numbers on paper.

But the smaller firm owner has the opposite problem; they avoid paid leads altogether because the shared version is the only thing they’ve seen and it does feel like a meat grinder and they’re not wrong about that. What they sometimes don’t realize is that exclusive leads from a vetted source are a different thing altogether; someone needed help, found one firm, called that firm, nobody else is calling them. That’s just a person who needs a PI attorney and didn’t have a referral and there’s nothing wrong with being findable for someone in that position.

What to Actually Change

How should a PI firm structure its lead sources? Three channels. Your own site and content, which is the cheapest source long-term but takes months to build. Exclusive paid leads where you’re the only firm getting the contact, which costs more per lead but signs at roughly 10%. And referrals, which cost nothing but show up when they show up. Cut shared leads unless the math actually works when you include intake time, and be honest about whether it does.

If you’re spending $15,000 a month on shared leads at $100 each and signing 4 cases, that’s roughly $3,750 per case plus a full intake team running all day to process the contacts that didn’t go anywhere. Shift that same $15,000 to exclusive leads at $350 each and you get about 43 leads; at 10% that’s 4 cases at $3,500 per case and your intake person handles it in half a day instead of all week.

Past that, your own SEO and content is the move because organic traffic is exclusive by default; they found your site, read your stuff, called you. Cost per case on organic is the lowest of any channel once it’s built out but it takes 6 to 12 months before real volume shows up so it’s not a short-term fix for anything.

Referrals are still the best lead any PI firm gets because trust is already there before the phone rings, but you can’t plan a year around hoping enough people mention you, which is why the exclusive paid piece fills the gap between what you need your marketing to produce and what referrals and organic give you on their own.

Whatever you do, track to signed cases. Lead count by itself doesn’t tell you much of anything. What you paid per signed case once you include lead cost, intake time, the recruiting when someone quits; that’s the number, and most firms have never calculated it which I still don’t really understand.

Not sure what you’re actually paying per signed case right now?

I’ll pull your last 90 days of lead data, separate the sources, figure out what each one really costs per case including intake time, and show you where the money goes. If your setup is doing better than you think I’ll tell you and we can skip the whole pitch. If the shared leads are bleeding you, you’ll see it in the numbers.