What is revenue attribution for law firms? Revenue attribution connects the original marketing touchpoint, whether a specific Google Ads keyword, a blog post, or a Local Services Ad, to the final case settlement revenue rather than stopping at the lead or the signed retainer. This matters because a $50 cost per lead campaign that produces 95 property damage claims is functionally worthless, while a $1,000 cost per lead campaign that produces one birth injury case settling for $5 million is the most profitable marketing asset the firm has. Revenue attribution replaces cost per signed case with return on ad spend as the primary metric and feeds settlement value data back to the ad platform so the algorithm learns which clicks produce revenue, not just which clicks produce phone calls.

Somewhere in your case management system right now there’s a med mal case that settled for seven figures last quarter, and if you trace it back to the marketing source that produced the lead, it probably came from a Google Ads campaign that your monthly report flagged as expensive because the cost per signed case was four or five times higher than your auto accident campaigns, and nobody at the time knew that the “expensive” campaign was the only one producing cases worth litigating.

Pull up your last three agency reports and look at what they measure, cost per lead, cost per signed case, maybe a conversion rate, and every campaign gets ranked on those numbers as if a slip-and-fall retainer and a birth injury retainer are the same unit of output.

Your cheapest campaign looks like the winner on every slide, and the one that quietly produces your highest-value cases looks like a line item that needs cutting, and nobody can see the problem because the data stops at the signed retainer and never connects to the settlement check that arrives eighteen months later.

Revenue attribution closes that gap, and it changes which campaigns look good and which ones look bad in ways that tend to reverse the decisions firms have been making for years based on incomplete data.

I wrote a detailed walkthrough of how the tracking plumbing works from click to signed case, and everything in that post is prerequisite infrastructure for what this post covers, which is extending the data chain past the signed case into the actual fee revenue so the algorithm and the firm and the agency are all optimizing for the metric that determines whether the practice is profitable.

A $5,000 Case and a $5,000,000 Case Look Identical on Every Report Your Agency Sends You

Why is cost per signed case a misleading metric? Because it treats every signed retainer as having equal value. A campaign producing slip-and-fall cases at $500 per signed case looks five times more efficient than a campaign producing surgical malpractice cases at $2,500 per signed case, but the malpractice cases may settle for 50 times more revenue. Optimizing for cost per signed case leads firms to cut their most profitable campaigns and scale their least profitable ones, which is how marketing teams celebrate “record lead volume” while gross revenue stagnates.

Open your agency dashboard right now and sort campaigns by cost per signed case, cheapest first, and the ranking you see is probably the exact inverse of the ranking you’d see if you sorted by revenue per dollar spent. The campaign at $500 per signed case looks efficient until you realize it’s signing property damage claims that settle for policy minimums, and the campaign at $2,500 per signed case looks wasteful until you realize it’s the only source producing surgical malpractice cases that settle for six and seven figures.

Running the math the other direction makes the gap obvious. A hundred signed cases at $500 acquisition cost is $50,000 in marketing spend, and if those cases settle for a combined $400,000 in fees the return is 8x.

Five signed cases at $2,500 acquisition cost is $12,500 in spend, and if those five settle for a combined $3 million the return is 240x, and the only way to see that 240x is to track what happens after the retainer, which is the part of the data chain that almost nobody builds and the part that changes every budget decision the firm makes once it exists.

Five Metrics in Order and Most Firms Never Get Past Number Two

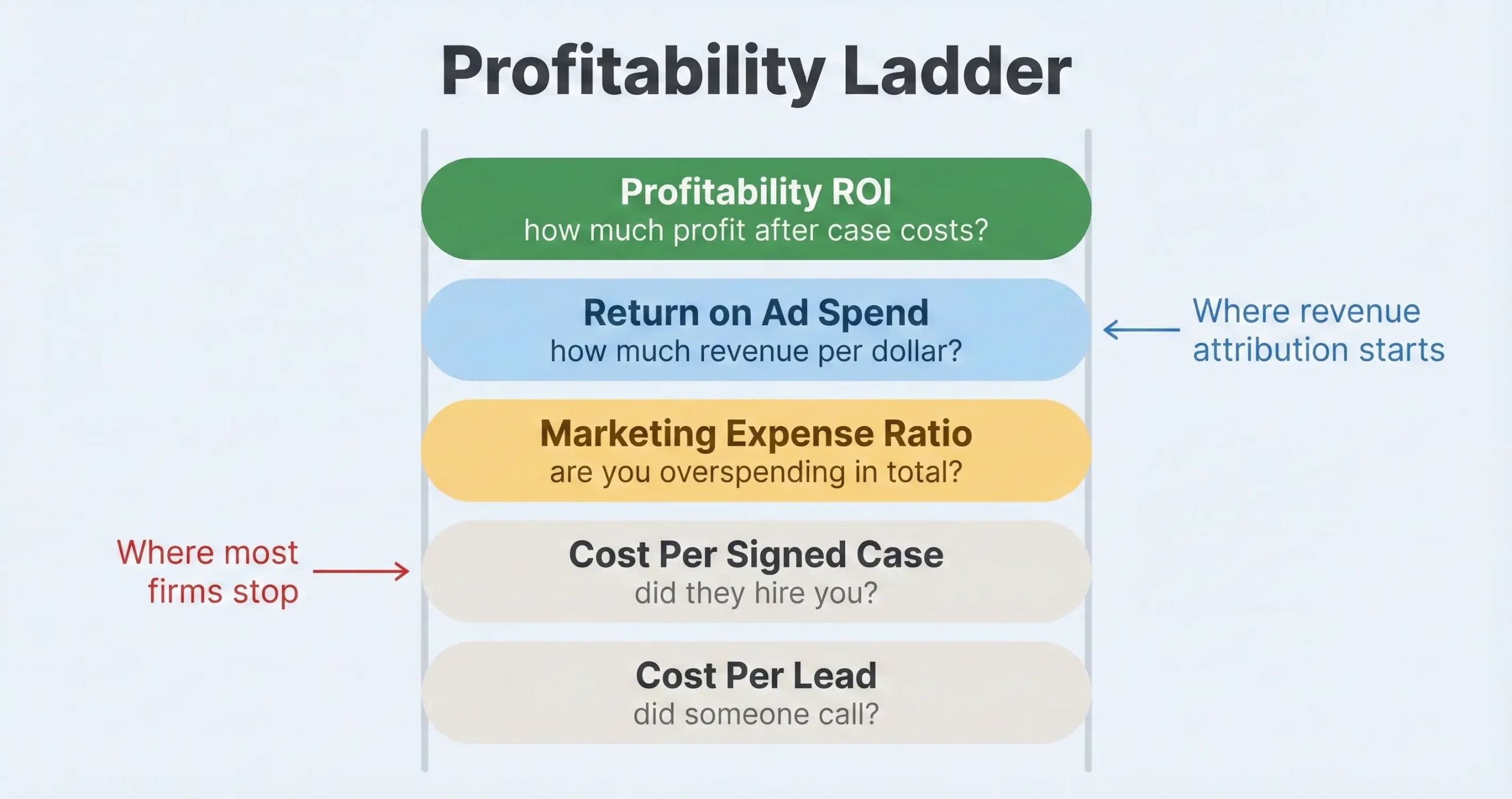

What metrics should a law firm track beyond cost per lead? The hierarchy from least to most useful: Cost Per Lead measures whether someone called. Cost Per Signed Case measures whether they hired you. Marketing Expense Ratio measures whether you’re overspending in total. Return on Ad Spend measures how much revenue each marketing dollar produces. Profitability ROI accounts for case costs like expert witnesses and depositions. Most firms stop at level two. Revenue attribution starts at level four.

Cost per lead tells you the ad made someone pick up the phone and nothing else, and a $50 cost per lead that produces 90% spam callers is worse than a $300 cost per lead that produces people with actual cases, which is why cost per lead is the wrong number for any decision more important than whether the ad copy is working.

Cost per signed case is better because it accounts for your intake team’s ability to close, but it still doesn’t know that the case signed on Tuesday is a policy-limit auto claim worth $15,000 and the one signed on Wednesday is a birth injury worth $4 million.

Return on ad spend is the first metric that connects the marketing spend to what the case is actually worth, and profitability ROI goes one step further by subtracting the case costs, which matters enormously for med mal firms where a case might generate $1 million in fees but cost $400,000 in experts and depositions to get there.

A Med Mal Client Read Your Blog Post Eighteen Months Before They Called and Your Tracking Doesn’t Know That

How does revenue attribution differ between personal injury and medical malpractice? PI attribution operates on speed. The sales cycle is minutes to hours, volume smooths out value variance, and predicted case values can be uploaded to the ad platform within 48 hours of intake. Med mal attribution operates on depth. The research phase can last months, the 30-day default cookie window in Google Ads is far too short, content-first attribution is critical because the blog post that built trust 18 months ago is often the most important touchpoint, and negative attribution matters because tracking which keywords produce rejected leads is as valuable as tracking which ones produce signed cases.

Personal injury attribution is a velocity problem. Someone gets hit, searches “car accident lawyer,” calls within an hour, and signs within a week, and the value variance between cases is manageable enough that cost per signed case works as a reasonable proxy for ROI if you’re running enough volume that the law of large numbers smooths out the spread.

Med mal attribution is a research problem. The person Googling “signs of surgical infection” isn’t hiring a lawyer today, they’re trying to understand what happened to them, and they might spend six months reading articles and comparing firms before they ever make a call.

If your attribution model only credits the last click, the branded search where they finally typed your name gets all the credit and the educational blog post that actually built the trust gets none, and then someone cuts the content budget because it “doesn’t produce leads” and the branded searches quietly drop three months later because the thing feeding them is gone.

You Can’t Wait Two Years for a Settlement to Tell Google Which Clicks Were Good

How do law firms track revenue attribution when cases take years to settle? By assigning predicted values at intake based on injury type rather than waiting for settlement data. When intake qualifies a lead, they score it: soft tissue injury = $500 predicted value, surgical case = $5,000, catastrophic or wrongful death = $50,000. These predicted values are uploaded to Google Ads within 24-48 hours through the offline conversion import, giving the algorithm near-real-time feedback on which clicks produce high-value cases without waiting years for the actual settlement figure. When settlements do close, the real revenue replaces the predicted value in the system, and the algorithm gets a second round of learning.

Waiting eighteen months for a med mal settlement to close before telling Google which keyword produced it means the algorithm spent eighteen months optimizing for the wrong signals, bidding the same amount for a click that produces a $50,000 case as it does for a click that produces a $5 million case, and by the time the real data arrives the campaign has already burned through a year and a half of budget without any value differentiation.

A firm I work with scores every qualified lead at intake using three tiers: $500 for soft tissue and property damage, $5,000 for surgical intervention cases, $50,000 for catastrophic injuries and wrongful death, and those values get uploaded to Google within 48 hours through the offline conversion import so the algorithm starts learning immediately which search terms and which audiences produce the cases that actually matter financially.

When the actual settlement arrives a year or two later, the real fee revenue overwrites the predicted value and the algorithm gets a second calibration, but the critical insight is that the first signal, the predicted value at intake, is what keeps the bidding strategy from treating every click identically during the entire lifecycle of the case.

The Difference Between an Algorithm That Bids the Same for Every Click and One That Bids $500 for a Catastrophic Case

What is target ROAS bidding and why does it matter for law firms? Target ROAS (return on ad spend) is an automated bidding strategy where the algorithm adjusts how much it’s willing to pay per click based on how likely that click is to produce high-value revenue. Unlike target CPA, which treats every conversion as worth the same amount, target ROAS uses the value data you feed it to bid aggressively for users it predicts will generate large settlements and conservatively for users it predicts will generate small ones. A firm feeding predicted case values can set a 400% ROAS target, and the algorithm will pay $500 per click for a search it associates with catastrophic injuries and $10 per click for a search it associates with property damage.

Target CPA bidding tells Google “get me leads for $200 each” and the algorithm does that, but it has no idea whether the lead it just acquired for $200 is a fender bender or a spinal cord injury because you never told it there’s a difference. Every click costs roughly the same regardless of what it might produce.

Target ROAS bidding tells Google “get me $4 in revenue for every $1 in spend” and now the algorithm has a financial incentive to find the clicks that produce high-value cases even if those clicks cost more individually, because a $500 click that produces a $50,000 predicted value case is a better use of budget than five $100 clicks that produce $500 predicted value cases, and the algorithm will make that tradeoff automatically once it has enough value data from your intake scoring to learn the patterns.

Cook County Verdicts Run Double What Lake County Pays and Your Bidding Should Reflect That

Can law firms adjust ad bidding based on location, device, or audience? Yes. Google Ads allows conversion value rules that multiply the predicted value of a conversion based on the user’s attributes. If data shows that cases originating from Cook County produce verdicts averaging twice what Lake County produces, the firm can apply a 2x value multiplier to Cook County conversions. Desktop users doing deep med mal research can be valued higher than mobile users for certain practice areas. Users in high-income zip codes or business professional audience segments can receive a value boost. These rules layer on top of the intake scoring system and give the algorithm even more granular signals about where to bid aggressively.

Geography changes case value more than most firms realize. A trucking accident case originating in a plaintiff-friendly jurisdiction can settle for three to five times what the same case settles for in a conservative venue, and if your bidding treats a click from both jurisdictions the same you’re systematically underbidding in the market where the money is and overbidding in the market where it isn’t.

Google’s conversion value rules let you build this into the automated bidding without touching the campaign every time. You set the multiplier, 2x for Cook County, 1.5x for certain Florida circuits, 0.5x for jurisdictions with damage caps, and the algorithm adjusts in real time so the firm’s spend concentrates where the settlement economics are strongest, which is a level of precision that manual bid management can’t match at scale.

If Someone Visited Your Cancer Misdiagnosis Page and a Tracking Pixel Told Facebook About It You Have a Problem

Does law firm marketing tracking create HIPAA compliance risks? Yes. When a user visits a med mal page about a specific condition like “failure to diagnose cancer” and a tracking pixel sends that page visit data to Facebook or Google, the ad platform now knows that a specific user has a health-related legal concern, which can constitute sharing protected health information with a third party. Recent enforcement actions, including the GoodRx settlement with the FTC, have established that health-related browsing data transmitted to ad platforms via pixels is a compliance risk. The solution is server-side tracking through Google Tag Manager server-side containers, where the user’s data goes to the firm’s secure server first, health-related identifiers are stripped, and only the anonymized conversion signal is passed to the ad platform.

Most firms don’t think of their website tracking as a HIPAA issue because they’re a law firm and not a hospital, but when someone visits your page about surgical malpractice and a Meta pixel fires and tells Facebook that this specific user was reading about surgical errors, you’ve just transmitted health-related browsing behavior to a third party, and recent enforcement has made clear that this isn’t a gray area anymore.

Server-side tracking through a GTM server container routes the user’s data to your own secure server before anything gets sent to Google or Facebook. Your server strips the page-specific health information and sends only the anonymized conversion signal, which means the ad platform knows a conversion happened but doesn’t know it came from someone reading about birth injuries. You keep the attribution data you need for revenue tracking without sharing the detail that creates the compliance exposure.

Want to know if your marketing is optimized for leads or for revenue?

Want to know if your marketing is optimized for leads or for revenue?

Send me your current reporting setup and I’ll show you where the data chain breaks between signed case and settlement value. If your agency reports cost per signed case but can’t tell you which campaigns produce the highest-value cases, there’s a gap in the pipeline that’s costing you money you can’t see. If the chain is already intact, I’ll confirm it.