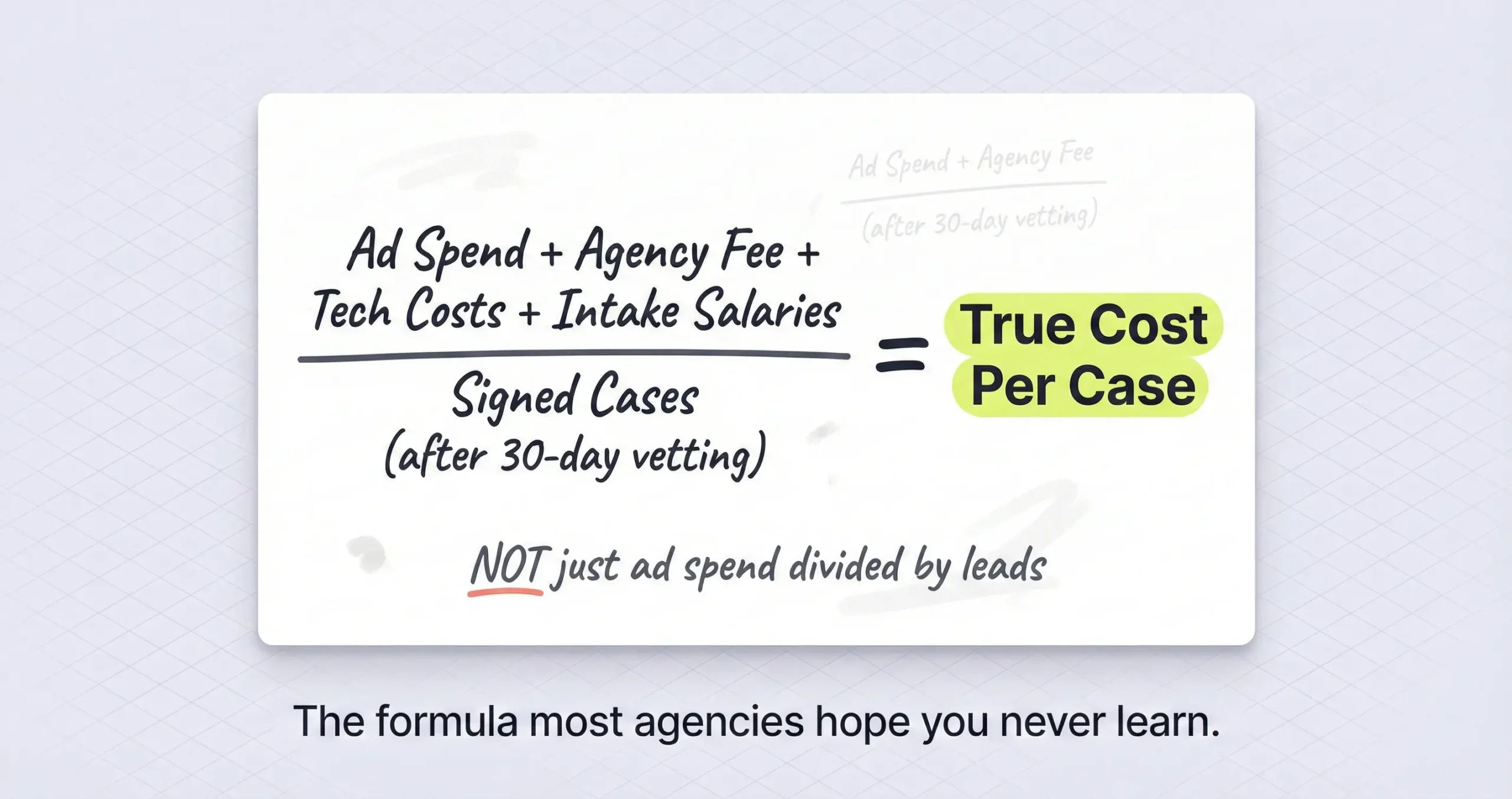

How do you calculate the true cost per signed case for a law firm? Add up everything you spend on marketing; ad spend, agency management fees, software costs for your CRM and call tracking, and the portion of intake staff salaries dedicated to processing leads. Divide that total by the number of signed retainers that survive your vetting period. That’s your real cost per signed case. Most firms only divide ad spend by leads, which gives a number that’s 30 to 50% lower than the actual acquisition cost and makes unprofitable campaigns look like they’re working.

Cost per lead is the number most agencies report on and it’s missing about 40% of the actual cost. The Google Ads spend is in there but the agency management fee usually isn’t, and neither is the CRM subscription, the call tracking platform, or the portion of the intake team’s salary that gets burned chasing the leads that don’t convert. A campaign that looks like it’s producing $200 leads is actually producing $280 or $340 leads once you load in everything the firm spends to process them, and that difference is enough to turn a profitable campaign into a breakeven one without anyone noticing because nobody added it all up.

This is the full cost per signed case formula with all four cost components that most calculations leave out, plus worked examples for PI, med mal, and mass tort, because a “good” number for a practice area where cases settle at $150,000 would be catastrophic for one where the average fee is $3,000 and the margins are thinner than most attorneys realize until they run the math with everything included.

Why Cost Per Lead Is the Wrong Number

Why is cost per lead misleading for law firms? Because a lead costs money to process even if it never becomes a case. If you generate 1,000 leads at $20 each for $20,000 total and only 1% convert because they’re low-intent, you sign 10 cases and your actual cost per signed case is $2,000. If you generate 100 leads at $200 each from high-intent searches and 15% convert, you sign 15 cases for the same $20,000 and your cost per signed case is $1,333. The campaign with the “expensive” leads produced 50% more cases at 33% lower cost, and it didn’t burn out your intake team processing 990 rejections.

The reason agencies love reporting cost per lead is that it’s a small number that’s easy to make look good. You can drive cost per lead down to $20 or $30 by broadening the targeting, using vague ad copy, or buying aged data from a broker, and the dashboard shows a great month. But the firm’s intake team is drowning in calls from people who don’t have a case, don’t have insurance, or aren’t in the right jurisdiction, and each of those calls costs staff time and phone system minutes and CRM storage that nobody’s counting.

The shift from lead quality to lead volume is where most of the money gets wasted, and the only way to see it is to calculate the cost per signed case instead of the cost per lead.

The Four Costs Most Firms Forget

What costs should be included in the cost per signed case calculation? Four categories: direct ad spend (Google, Facebook, TV, LSA), agency and management fees (typically 10-20% of ad spend or a flat monthly retainer), technology costs (CRM, call tracking, texting platforms, e-signature tools), and intake human capital (the salaries and benefits of the people who call, screen, and sign leads). Most firms only count the first one. Leaving out the other three understates your acquisition cost by 30 to 50%, and that gap is where the math starts lying to you.

The agency fee is the one that’s easiest to overlook because it shows up on a separate invoice. If you spend $10,000 on ads and pay the agency $2,000 to manage them, your actual marketing output is $12,000 and ignoring the agency fee understates your cost by almost 17%.

The technology costs add up faster than you’d expect. A CRM seat, a call tracking subscription, an automated texting platform, and an e-signature tool might run $800 to $1,500 a month combined. That’s real money that exists because of the marketing operation, and it belongs in the numerator.

But the biggest cost is intake labor. If you employ two people whose primary job is calling and qualifying leads, their salaries are part of the marketing cost because without them the leads don’t convert. At Percy we had intake specialists and for a long time I treated their salaries as “operations” instead of “marketing” and the cost per signed case I reported was lower than reality, which made it look like we could afford to spend more on ads when in fact the margins were tighter than I thought.

What Counts as a “Signed Case”

How should law firms define the denominator in cost per signed case? A signed case means a fully executed retainer agreement. Not a qualified lead, not a booked consultation, not a verbal commitment. For practice areas with high rejection rates like med mal and mass tort, firms should also calculate net signed cases; retainers that survive a 30-day vetting period. If you sign 50 PI cases and 10 get dropped within a month because liability fell apart or there was no insurance, your net signed cases are 40 and your real cost per case is 25% higher than the gross number suggests.

This distinction matters more in mass tort than anywhere else. The research on mass tort lead quality shows a fallout rate of roughly 40% from signed retainer to filed case, which means if you’re calculating cost per signed case at the moment of signature you’re dramatically underestimating what each surviving case actually cost you.

For PI the vetting fallout is lower, maybe 10 to 20%, but it still exists. A rear-end collision that looked like a clear liability case turns out to have a dash cam showing your client ran a red light, or the injuries are below the firm’s threshold after the medical records come in. If you don’t adjust the denominator for those cases that fall out, your cost per signed case is artificially low and your budget decisions are based on numbers that won’t hold up when the settlements come in.

The Math for PI, Med Mal, and Mass Tort

What does cost per signed case look like by practice area? For a PI firm spending $64,000 per month (ads plus agency plus tech plus intake labor) and signing 40 cases, the cost per signed case is $1,600, which represents about 13% of the average case fee. For a med mal firm spending $45,000 and signing 5 cases after medical review, it’s $9,000 per case, but that’s only 6% of the average fee because case values are so much higher. For mass tort buying 100 signed retainers at $3,500 each plus $500 in verification costs, with 20% fallout, the net cost per surviving case is $5,000. The absolute dollar amounts look dramatically different but the acquisition cost as a percentage of case value is what actually determines profitability.

The PI example is the one that made it click for me at Percy. When you add the agency fee, the intake salaries, and the tech stack to the ad spend, the cost per signed case goes from whatever the agency reports to something 30 to 50% higher, and that’s the number you need to use when deciding whether to scale or cut a campaign. At a $1,600 cost to sign a PI case that generates $12,000 in fees, the marketing is eating about 13% of the revenue, which is well within the range where the firm is profitable.

The med mal example is the one that surprises people because the cost per case is $9,000, which sounds enormous compared to PI. But med mal case values run $150,000 to $500,000 or more in fees, so the $9,000 acquisition cost represents only 6% of revenue. The med mal firm is actually spending a smaller percentage of its revenue on marketing than the PI firm, even though the absolute number is five times higher. That’s why you can’t compare cost per signed case across practice areas without looking at it as a percentage of the case value.

Mass tort has an extra wrinkle because firms often buy signed retainers from vendors instead of generating leads, and the vendor price feels like the full cost until you add the internal verification team and account for the fallout rate. A $3,500 vendor retainer becomes a $5,000 net cost per surviving case once you add QA and subtract the 20% that get dropped, and if you don’t run that math before committing to a vendor contract you can end up in a cash flow problem that doesn’t show up until the vetting period is over.

Why Cutting Intake Costs Makes Marketing More Expensive

Can cutting intake staff reduce cost per signed case? No. It does the opposite. If a PI firm saves $8,000 per month by eliminating dedicated intake and having busy attorneys answer phones, the contact rate drops from 80% to 50% because lawyers are in court and depositions. With the same leads, signed cases drop from 40 to 25 and the cost per signed case jumps from $1,600 to $2,240. The $8,000 “savings” actually increased the cost per case by $640 each across 25 fewer cases. Dedicated intake pays for itself by converting leads that would otherwise die in the voicemail.

This is the counterintuitive part that most firms get wrong. When money gets tight the instinct is to cut overhead, and intake staff look like overhead. But intake is the mechanism that turns marketing spend into revenue, and without it the leads just sit there getting cold while the firm pays for them anyway.

The research is consistent on this; firms that respond within 5 minutes convert at rates 400% higher than firms that wait hours, and dedicated intake staff are how you hit that window. If a lawyer is in a deposition until 3pm, every lead that came in between 9am and 3pm got cold, and the marketing dollars that generated those leads are gone regardless of whether anyone called them back.

Want to know your actual cost per signed case?

Send me your ad spend, agency fees, and how many cases signed last quarter. I’ll calculate the loaded number and show you where the costs are. If the math already works I’ll tell you.