How do you evaluate lead quality from a legal marketing agency? Stop looking at how much each lead costs and start calculating what each signed case costs when you add up everything; the agency fee, the ad spend, and the time your intake staff burned chasing the ones that went nowhere. Then figure out what percentage of the leads your agency sends actually have a case you can take, benchmark those numbers against what’s normal for your practice area and your city, and check whether the leads are being sold only to you or to four other firms at the same time. If your agency can’t tell you how many of last month’s leads turned into signed cases, they’re tracking the wrong thing and so are you.

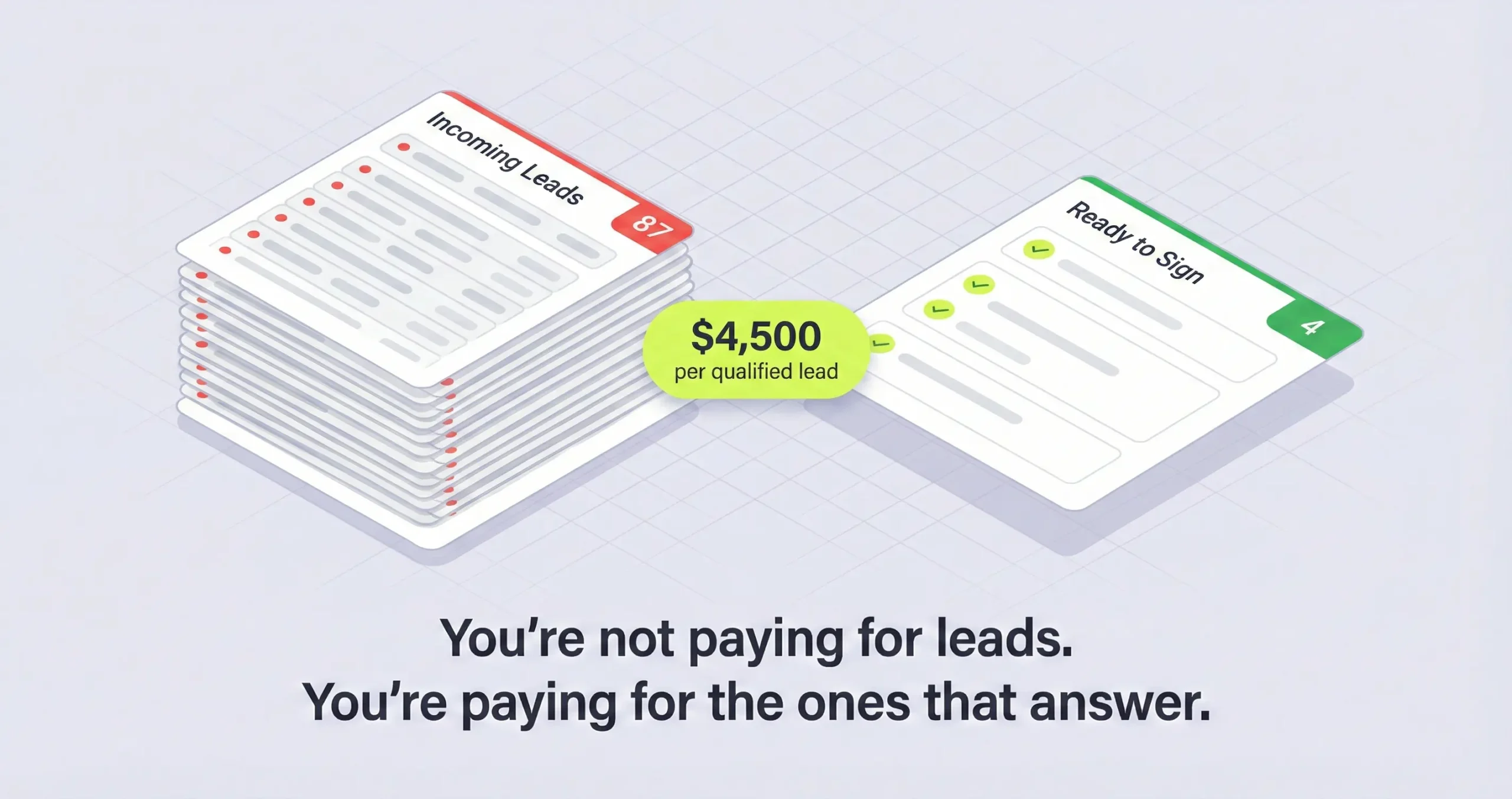

Your agency sends you 80 leads and you signed 3 cases and both of you think the other one screwed up. The agency points at the 80 and says the marketing is working. You point at the 3 and say it’s not. And you’re both using the word “lead” like it means the same thing to both of you but it doesn’t; to them a lead is a phone call about a legal matter and to you a lead is a case you’d actually take, and that gap is where $4,000 a month goes to die without anyone being technically wrong about their own numbers.

The fix for this is boring and nobody wants to hear it because it’s not a marketing fix, it’s a definitions conversation. It means sitting down with whoever manages your campaigns and spelling out exactly what you will and won’t take; not “we do personal injury” but “car accidents with clear liability, minimum $50,000 in medical bills, no slip and falls, no cases older than a year, and if someone calls about a dog bite route them out before they hit intake.” Until that conversation happens the agency is guessing, and when agencies guess they optimize for volume because volume is what makes their report look good.

The Two Types of Leads and Why Your Agency Only Reports One

What is the difference between someone who called and someone who has a case? Your agency counts anyone who filled out a form or stayed on the phone for 60 seconds as a “lead” because that’s what they get paid on. But for your firm, a lead only matters if the person actually has a case you can take; right jurisdiction, right practice area, within the filing deadline, and with damages worth pursuing. The gap between “someone called” and “someone has a case” is where most of your marketing budget disappears. The number your agency should be reporting and probably isn’t is what percentage of their leads actually pass your intake screening, because that’s the number that tells you whether their targeting is working or whether they’re just sending you volume.

I’m starting here is because the definition of what counts as a qualified legal lead is the foundation of everything else in this post, and if you and your agency aren’t working from the same definition then every other number you look at is built on bad data.

The way most agencies work is they count a “lead” as any trackable contact event. Someone filled out a form, someone called and talked for at least 60 seconds, someone started a chat. The agency counts that as delivered because by their business model it is; a human being touched your marketing and a record was created in the system.

But what you need is different because you need someone whose case your firm can actually take. For PI that means the other driver was at fault, there’s documented medical treatment, and there’s insurance on the other side. For family law that means the person can pay a retainer. For mass tort that means the right product and the right diagnosis. And the distance between “someone called” and “someone has a real case” is usually enormous.

So the metric that changes everything is the qualification rate. If your agency sends 100 contacts and 40 of them pass your intake screening, that’s a 40% qualification rate which is strong. If 100 contacts produce 8 qualified leads, that’s 8% and something is wrong with targeting, and now you have a number to show them instead of just saying “the leads are bad” which gets you nowhere.

What Leads Should Actually Cost by Practice Area and Market

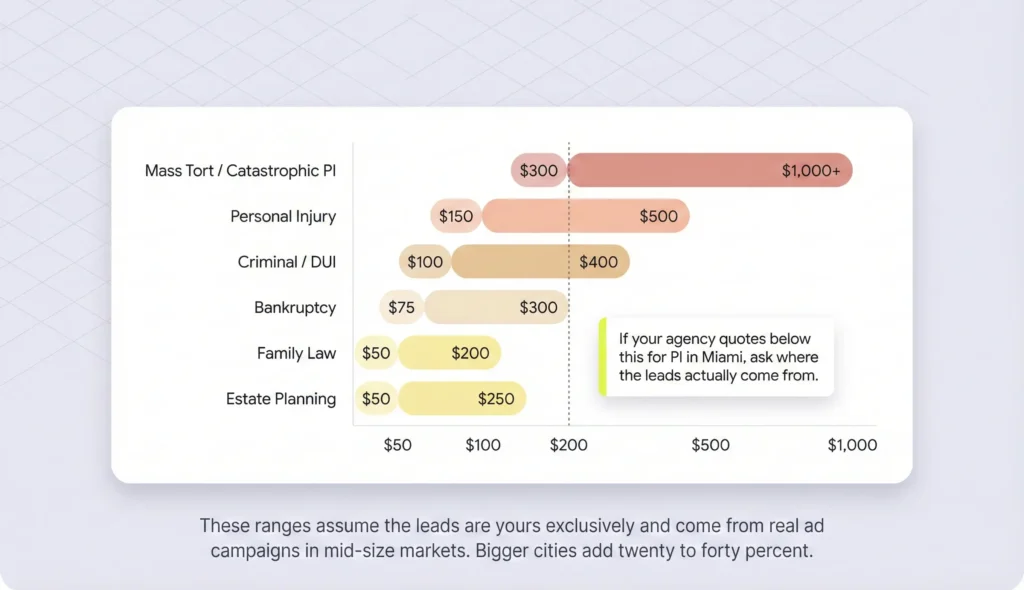

What should law firm leads cost by practice area? It depends on what the cases are worth. Mass tort and catastrophic injury leads run $300 to $1,000+ each because the case values are six to seven figures and every big firm in the country is bidding on those keywords. Standard personal injury runs $150 to $500. Family law runs $50 to $200. Criminal defense runs $100 to $400. And those ranges go up 20 to 40 percent in expensive metros like Miami, New York, and LA. If someone is offering you “exclusive personal injury leads” in Miami for $50 each, that’s not possible through normal advertising channels and those leads are almost certainly recycled, fake, or being sold to multiple firms.

And benchmarks matter because without them you’re just guessing whether your agency is doing well or burning your money. Telling me your leads cost $200 each means nothing unless I know what practice area, what city, and whether those leads are yours exclusively or shared with other firms.

For the expensive practice areas like mass tort and catastrophic injury, expect low volume at high cost. Maybe 10 to 20 qualified leads per month from a serious budget, because the keywords cost hundreds per click and the screening criteria are narrow. If an agency promises 200 mass tort leads at $50 each, they’re either paying people to fill out forms through mobile game reward systems, or buying old data from a broker and selling it to you as fresh, and I’ve seen both of those happen more than I’d like to admit.

For general PI, family law, and criminal defense the volume should be higher but the people calling are usually contacting multiple firms at once. Whoever calls back first tends to get the only real conversation, which means speed matters as much as the lead quality itself.

The geography markup is real and it changes the math significantly. The top PI keywords in LA or Miami run $500 to $1,000 per click, so a $200 cost per lead in those markets actually means the agency is doing efficient work, while the same $200 in Indianapolis might mean they’re going after people who are researching rather than people who need a lawyer today. Your Google Ads performance has to be measured against what’s normal for your specific market, not against national averages that don’t mean anything.

Whether Your Leads Are Sold Only to You or to Four Other Firms

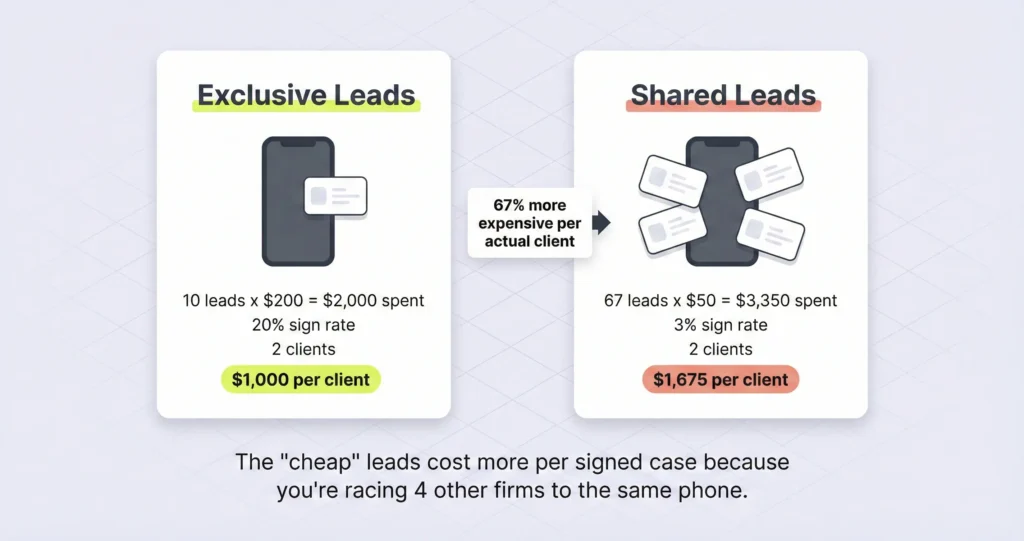

What is the difference between exclusive and shared legal leads? Exclusive leads are sold to your firm only and typically cost 3 to 5 times more than shared leads, but they convert at 10 to 30 percent because the person thinks they’re talking to you specifically. Shared leads get sold to 3 to 5 firms at once, cost less per lead, but convert at 2 to 15 percent because the person’s phone rings 4 times in 90 seconds and whoever answers first wins. When you do the actual math, exclusive leads at $200 each with a 20% sign rate cost you $1,000 per signed case. Shared leads at $50 each with a 3% sign rate require about 67 leads to get 2 clients, costing $3,350 total or $1,675 per case. The “cheap” leads end up costing 67% more per actual client.

This is the part that changes how most attorneys think about their marketing budget because the shared lead model looks great on paper. You pay less per contact, you get more volume, and the monthly report looks full of activity.

But what actually happens is that when someone fills out a request on a “find a lawyer” portal, their phone starts ringing from 3 to 5 different firms within about 90 seconds, and whoever gets through first usually wins regardless of whether they’re the best fit for the case. I’ve seen firms invest in faster intake systems specifically to win that race, and some do well with it, but the cost of staffing for that speed never shows up in the “cost per lead” number your agency reports.

Exclusive leads cost more upfront but the conversion math usually wins. When someone fills out a form on your actual website or clicks your ad and calls your number directly, they think they’re contacting your firm specifically and that intent matters for conversion. If you own your content and SEO instead of renting leads from directories, every lead is exclusive by definition because it came from your own presence.

The question to ask your agency is straightforward; are these leads being sold only to me. And if they say yes, ask them to put it in the contract, because some agencies sell “exclusive” leads that are technically exclusive within their system but the same person also appears on two other platforms at the same time.

How to Score Your Leads So You Can Prove Quality Changed

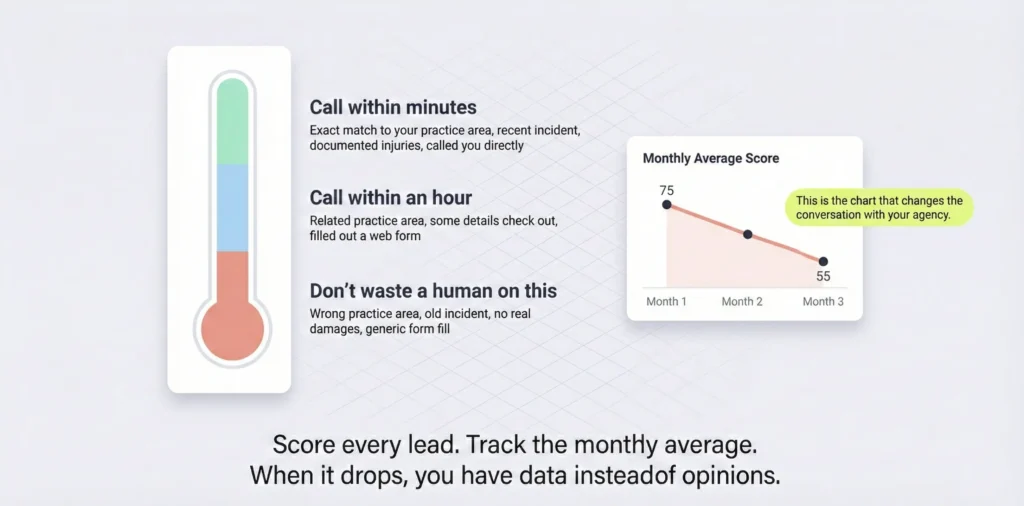

How should a law firm track whether lead quality is getting better or worse? Give every lead a score based on two things; whether they have a case you can take and how they behaved before they contacted you. A lead that matches your exact practice area, has a recent incident, went to the hospital, and called you directly scores high. A lead that picked the wrong practice area, had their incident three years ago, and filled out a generic form scores low. Track the average score by month. When the average drops, you have a number to show your agency instead of just a feeling, and that conversation goes completely differently.

And most firms don’t do this because it sounds like busywork, and honestly it is for the first month or two, but once you set it up in your CRM it runs automatically and it becomes the single best tool you have for holding your agency accountable.

The case quality side is simple because you already know what makes a case worth taking. Did the incident happen recently enough to file. Does it match what your firm handles. Were there real injuries with medical records. Is there insurance on the other side. You’re just putting points on the things your intake team already screens for; an exact practice area match gets 50 points, a related match gets 30, and a total mismatch is an automatic zero. A recent incident gets 20 points, hospitalization adds 30.

The behavior side is the part most firms miss entirely. Someone who called your office directly shows more urgency than someone who filled out a form, so the phone call gets more points. Someone who visited your case results page or read about your specific services before reaching out has higher intent than someone who clicked an ad and submitted their info without reading anything.

And where this gets powerful is the trend. If the average lead score from your agency was 75 three months ago and it’s 55 now, you don’t have to argue about gut feelings. You pull up the chart and say “quality dropped 27%, what changed in your targeting” and that’s a conversation that actually produces answers.

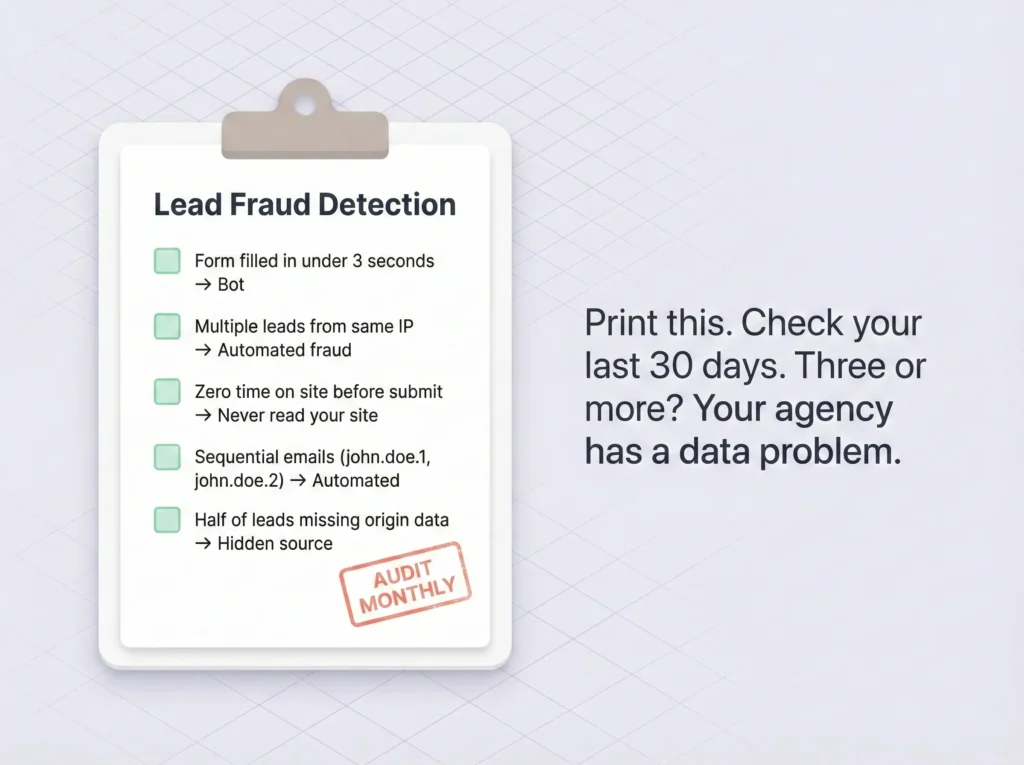

How to Catch Fake Leads and Source Manipulation

How do you tell if your agency is sending you fake or recycled leads? Check four things. First, if someone filled out your contact form in under 3 seconds, that’s a bot because a real person needs at least 30 seconds to type their information. Second, if multiple leads come from the same internet address or from a server farm instead of a home internet connection, that’s automated fraud. Third, if leads show up with zero time spent on your website before submitting the form, they never actually read anything. Fourth, if the email addresses follow a pattern like john.doe.1, john.doe.2, john.doe.3, those are automated submissions. Beyond the fake leads, check where the leads are actually coming from; if your agency says they’re running Google Ads but the tracking data shows the leads came from some random directory site, they might be buying cheap leads from a third party and reselling them to you at a markup.

And I want to be direct about this; lead fraud in legal marketing is a real business and it’s growing because the money is there. Someone who can generate a fake “personal injury lead” and sell it for $200 has plenty of reason to do that thousands of times, and the bots have gotten sophisticated enough that the leads look real until you actually try to call them.

The easiest audit is checking how fast your forms get filled out. Pull the submission data from your CRM or form platform and look at how many seconds each one took. If you have 20 leads this month and 6 of them filled out the form in under 3 seconds, those aren’t humans. A real person typing their name, phone, email, and describing their situation takes 30 to 45 seconds minimum.

The second audit is checking where the leads came from. Every real lead should carry data showing its origin. If the agency runs Google Ads, the tracking should show that the person came from Google through a paid ad for a specific campaign. If a bunch of leads show up as “direct traffic” with no origin data at all, the agency might be stripping that information to hide the fact that the leads came from a cheap third-party source instead of the premium ad campaigns you’re paying for.

And here’s something I tell every firm to do; have someone you trust fill out the form through the agency’s actual ad. Watch how it shows up in your system. If the source says “Google Ads” you’re fine. If it says something like “Affiliate Network 4” or a name you’ve never heard, your agency is buying leads from a middleman, and that changes the contract conversation significantly.

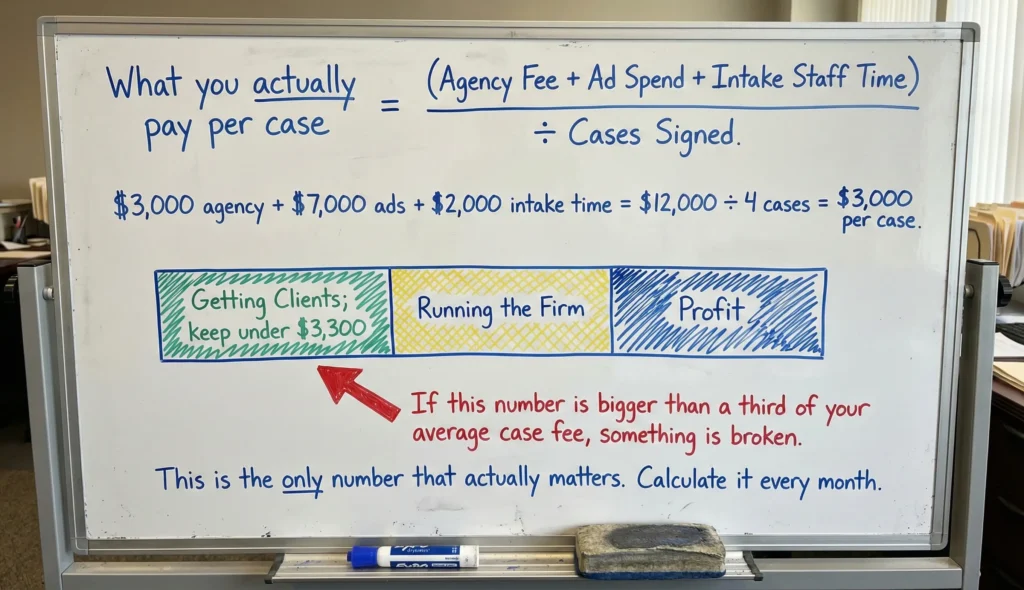

The Real Cost Per Signed Case and the One Third Rule

How do you figure out what you’re actually paying per signed case? Add up three things; what you pay the agency each month, what you spend on ads, and what your intake staff costs for the time they spend on leads from that agency. Divide that total by the number of cases you signed. If you pay a $3,000 agency fee, spend $7,000 on ads, and your intake person spends about $2,000 worth of their time processing those leads, your total is $12,000. If you signed 4 cases, you paid $3,000 per case. The rule of thumb is that number shouldn’t be more than a third of what the average case is worth to you. If your average PI case generates $10,000 in fees, your cost per signed case ceiling is about $3,300. If you’re above that, something in the pipeline is broken.

And the reason this matters more than cost per lead is because cost per lead is a vanity number that hides what you’re really paying. An agency can show you leads at $100 each and that looks reasonable, but if you need 25 of those leads to sign one case, you just spent $2,500 on leads alone before you count the agency retainer or your intake person’s time.

The intake overhead is the variable nobody talks about and it changes the math a lot. Your intake coordinator’s salary, divided by the percentage of their time spent on leads from this particular agency, is a real cost. If they spend 40% of their week processing leads from one source, 40% of their loaded salary goes into that source’s cost calculation.

And if 80% of those leads are junk, your intake person is spending most of their day on calls that go nowhere, which is how you lose good intake staff and then you’re paying to recruit and retrain while the leads keep piling up unanswered.

And the one third rule is the benchmark that tells you whether any of this is sustainable. One third of what a case earns goes to getting the client, one third goes to running the firm, one third is profit. If your cost per signed case creeps past 33% of your average case fee, something needs to change, and your budget allocation should shift until the math works again.

Which Content and Channels Send You the Best Cases

How do you figure out which parts of your marketing produce the best leads? Ask your agency one question they probably can’t answer: which pages on your website produce leads that actually sign. If your blog brings in 20% of your leads but 40% of your signed cases, that’s your best channel and it’s probably getting the least budget. A lead who found you by reading a specific article about their exact legal situation and then called shows much higher intent than someone who clicked a generic “Free Consultation” banner, and the sign rates reflect that gap completely.

The reason this matters for evaluating your agency’s approach is that a good agency builds content that pre-qualifies people before they ever contact you. If every lead comes from a generic landing page that says “Need a Lawyer? Call Now!” the agency is running a volume play and hoping your intake team sorts out the mess.

The question to ask is “show me sign rates by content source” and if the agency can’t answer that, they’re not tracking deeply enough. Anyone managing your website and content should know which pages produce clients, not just which pages produce clicks, and that data should drive where the budget goes next.

Want me to run this audit on your current agency’s leads?

I’ll pull your last 90 days of lead data, apply the scoring framework from this post, calculate what you’re really paying per signed case, and check for the fraud signals most firms miss. If your agency is actually doing a good job I’ll tell you that and save you the hassle of switching. If the numbers show a problem, you’ll have the data to fix it or the leverage to renegotiate.