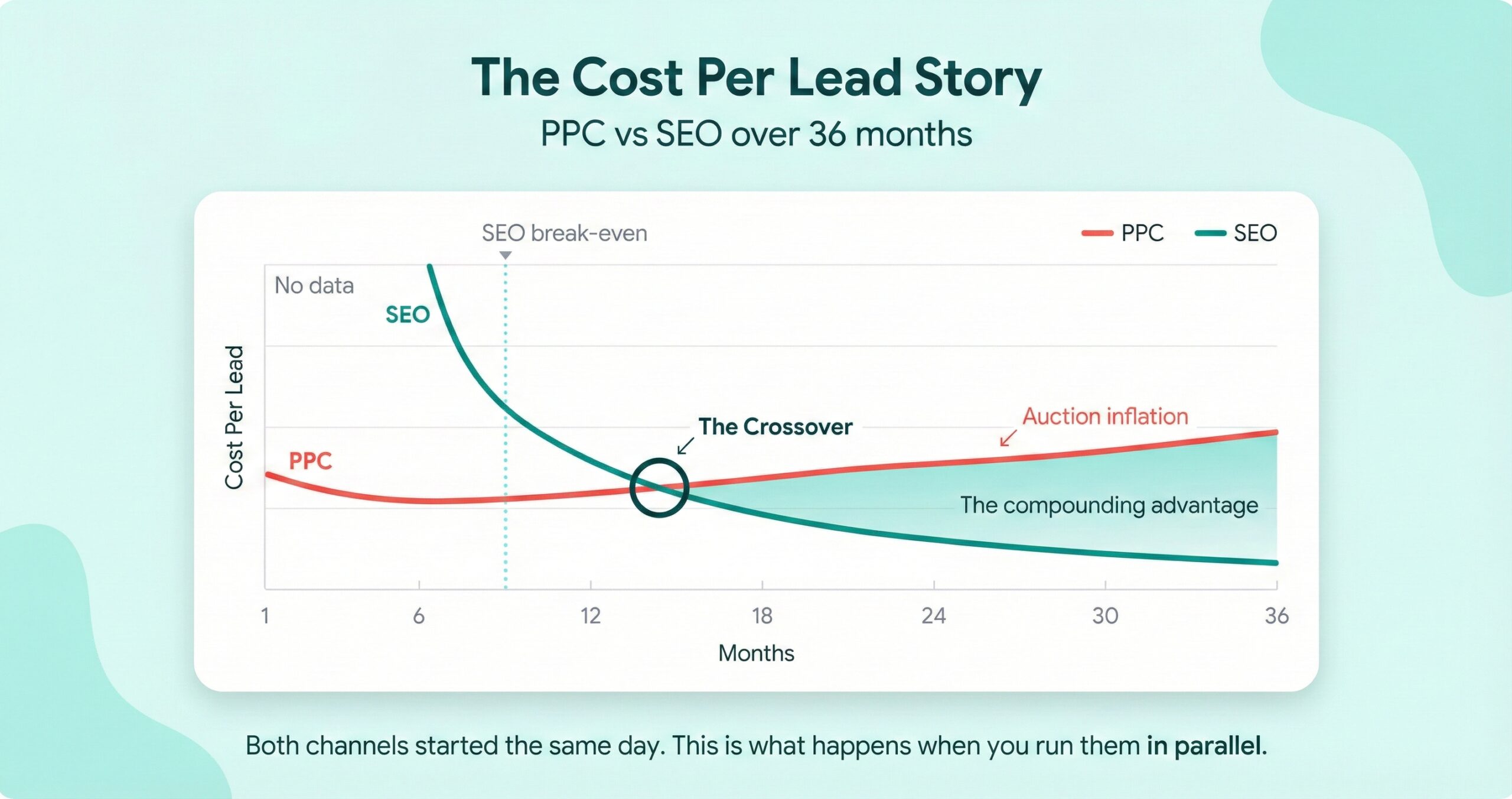

How do PPC and SEO timelines compare for law firms? PPC produces clicks within 72 hours and signed cases within weeks, but cost per lead stays flat or rises annually due to auction inflation. SEO produces zero leads for 3-6 months while the domain builds authority, then cost per lead drops steeply as organic traffic compounds against a fixed retainer. The crossover point where SEO becomes cheaper per lead than PPC typically occurs between months 14 and 18. Running both channels simultaneously, called the blended approach, lets PPC fund immediate cash flow while SEO builds the long-term asset that eventually reduces total acquisition cost. Source: Walker Advertising recommends the blended approach for new firms entering competitive legal markets.

Two budgets leave the firm’s account on the same Monday morning, one going to Google Ads and the other going to an SEO retainer, and what happens to each dollar over the next thirty-six months is so different that watching them side by side is the only way to understand why one channel feels like it’s working while the other feels like it isn’t, and why that feeling inverts completely after the first year.

I’m not going to argue that one is better than the other because the answer depends on which month you’re standing in. At month two, PPC is the only thing keeping the lights on. At month twenty, SEO is generating leads at a fraction of what PPC costs. The question isn’t which one to run, it’s understanding what each one is doing at every point along the way so you know what you’re paying for and when to expect the return.

Week One the PPC Campaign Has Thirty Clicks and the SEO Campaign Has a Spreadsheet Full of Broken Links

What happens in week one of PPC vs SEO? PPC campaigns go live within 72 hours of setup. Impressions begin immediately, clicks follow within hours, and the first phone calls can arrive by Friday of the first week. The campaign is in its “learning phase” where Google’s algorithm is testing ad placements and the cost per acquisition is at its highest. SEO in week one is a technical audit: identifying broken links, fixing page speed, verifying the Google Business Profile, and drafting initial schema markup. There is zero visibility from SEO at this point. To the partners, PPC already looks like it’s working and SEO looks like nothing is happening.

PPC goes live within 72 hours of account setup and the firm has impressions the same afternoon and clicks by the next morning and potentially a phone call by end of week, and even though the cost per lead during this learning phase is at its worst because Google is still testing placements and match types, the phone is ringing and that matters more than efficiency when you’re a new firm trying to prove the model works.

Meanwhile the SEO retainer at this same moment is paying a technician to run crawl reports and flagging 404 errors and checking whether the site loads in under three seconds on mobile, and the deliverable at the end of week one is a spreadsheet of things that are broken, not a single phone call, and explaining that to a partner who just watched the PPC line ring the phone is the first of many conversations about what SEO actually looks like in the early months.

At Month Three PPC Has Stabilized at Ninety Leads and SEO Has Exactly Zero Signed Cases

What does PPC vs SEO look like at month three? PPC is through its learning phase and has stabilized. Negative keywords have been added to filter waste, bidding strategies are optimized, and cost per lead has dropped from its week-one peak. The firm has a predictable pipeline: a knowable number of leads per week at a knowable cost. SEO at month three has indexed pages, rising impressions in Search Console (typically 1,000-5,000/month), and long-tail keywords appearing at positions 30-50, but zero signed cases from organic traffic. The divergence is at its widest. PPC looks like the clear winner by every metric that matters to the partners.

Three months in and the PPC campaign has found its rhythm, negative keywords have filtered out the waste searches, the bidding algorithm has learned which placements convert, and cost per lead has dropped from whatever chaotic number it started at down to something the firm can project forward, maybe $200 a lead, maybe $400 depending on the practice area and geography, but it’s a number now instead of a guess.

On the organic side at month three there are pages indexed and impressions climbing in Search Console and maybe some long-tail phrases appearing at position 35 or 40 where no human being will ever scroll deep enough to find them, and the monthly report from the SEO team shows charts trending in the right direction, but the partners are looking at a column that says “Leads from organic: 0” and comparing it to the PPC column that says “Leads from paid: 87” and every instinct in the room says to move the SEO budget into ads.

Resisting that instinct is the entire strategic bet of the blended approach. The PPC budget is funding immediate cash flow that keeps the firm operational while the SEO investment is building an asset that doesn’t produce revenue yet but will eventually produce leads at a fraction of the cost, and the firms that move the SEO budget into PPC at month three are choosing a strategy that works forever at a fixed price over one that gets cheaper every year.

Somewhere Between Month Fourteen and Month Eighteen the Cost Lines Cross and Nobody Notices

When does SEO become cheaper than PPC for law firms? The crossover typically occurs between months 14 and 18. By this point, SEO has built enough domain authority that core keywords are ranking on page one, organic traffic is generating consistent leads, and the fixed monthly retainer is being divided by a growing number of leads, pushing cost per lead down month over month. PPC cost per lead remains flat or increases slightly due to auction inflation. The crossover is quiet because most firms track the channels separately and never plot them on the same graph. After the crossover, every additional month widens the gap as SEO continues to compound while PPC stays linear.

Fourteen months into a campaign where both channels have been running simultaneously, the SEO line on the cost-per-lead chart drops below the PPC line and keeps falling, and in the firms I’ve worked with nobody noticed when it happened because the channels are tracked in separate dashboards by separate teams and nobody thought to put them on the same graph until I asked them to.

PPC at month fourteen is doing exactly what it was doing at month six: producing a predictable number of leads at a predictable cost that edges up slightly each quarter because more competitors are entering the auction and bidding on the same keywords, and the only way to get more volume is to spend more money at the same or higher rates.

Organic at month fourteen is a different machine entirely. Content published during months two through six has matured and is ranking on page one for terms that were on page four a year ago, and the firm’s domain authority means new content ranks in weeks instead of months, and the retainer is still $5,000 or $7,000 a month but the leads it’s generating have tripled since month nine, so the math per lead drops every month while PPC’s math stays flat.

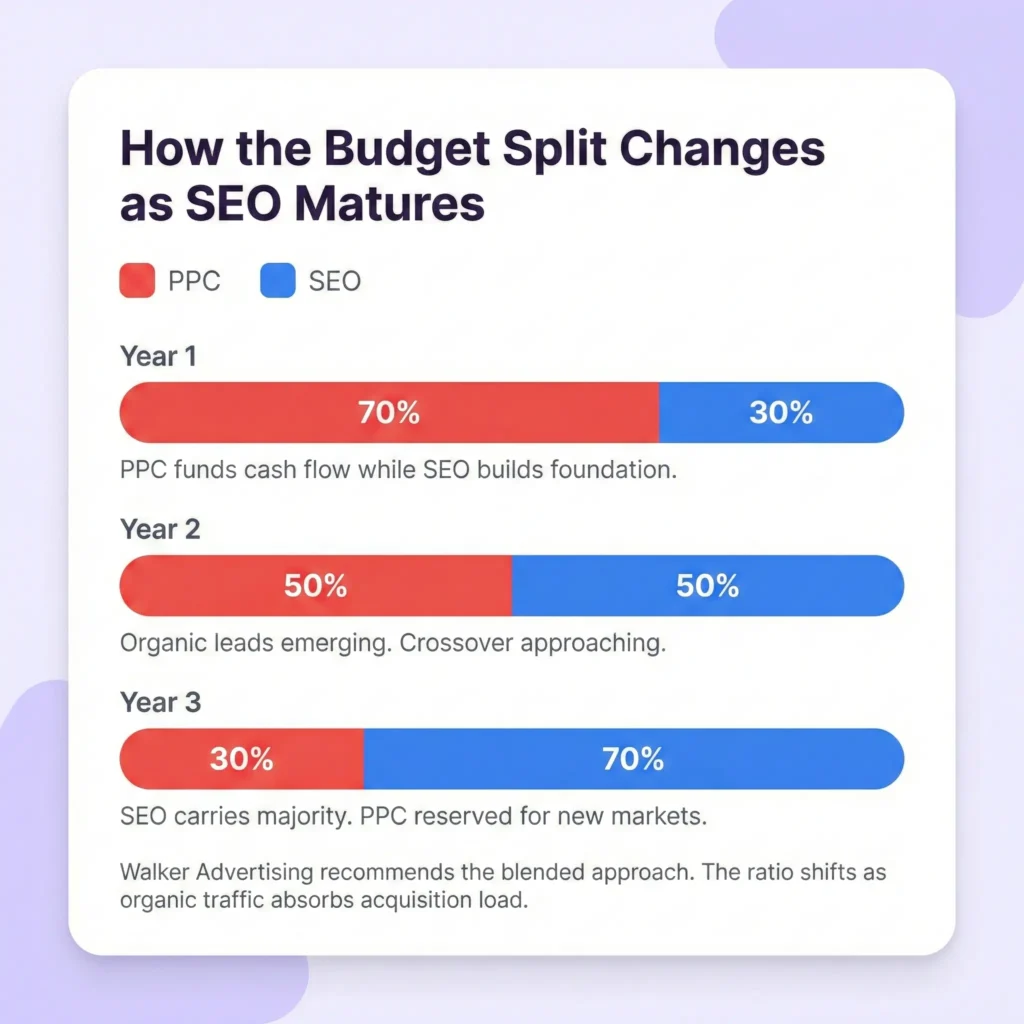

By Year Three One Channel Is a Flat Expense and the Other Is an Asset You Could Sell

What does PPC vs SEO look like after three years? After 36 months, PPC remains a variable expense that produces leads only while money flows into the account. If the firm stops paying, visibility disappears instantly. The cost per lead is the same or higher than it was in year one. SEO after 36 months is a compounding asset. Content written in month four is still generating traffic. The domain ranks for hundreds of keywords. Cost per lead continues declining because organic traffic grows while the retainer stays relatively fixed. The SEO infrastructure has enterprise value: a firm with a website generating 10,000+ qualified organic visitors per month has a tangible asset that increases the firm’s valuation. The blended approach at year three typically shifts allocation from 70/30 PPC/SEO toward 30/70 as organic traffic absorbs more of the lead generation.

Thirty six months of PPC and the campaign is doing the same thing it did in month four except the clicks cost more because the auction inflated and there are two more competitors bidding on the same terms, and if the firm turned off the ads tomorrow morning the phone would stop ringing by tomorrow afternoon because paid visibility vanishes the second the budget stops.

Thirty six months of SEO and the firm’s website ranks for hundreds of keywords that generate traffic without any per-click cost, content written during months three through twelve is still producing consultations two years after it was published, and the monthly retainer has stayed roughly the same while the lead volume tripled, which means cost per organic lead at year three is a third of what it was at the crossover point and still dropping.

The part that doesn’t show up on a monthly P&L but matters at the strategic level is that the SEO infrastructure is an asset with enterprise value. A firm with a website generating 10,000 qualified organic visitors a month has something a buyer would pay for, and the PPC campaign that generated the same number of leads over three years left nothing behind except invoices, which is why the blended approach shifts allocation from 70/30 favoring PPC in year one to 30/70 favoring SEO by year three as the organic asset absorbs more of the acquisition load.

If You Can Only Afford One Channel the Answer Depends Entirely on Whether You Can Survive Six Months Without Organic Leads

Should a law firm choose PPC or SEO if they can only afford one? If the firm needs cases immediately to maintain cash flow, PPC is the only viable option. SEO cannot produce signed cases in the first six months. If the firm has existing revenue from referrals or other sources and can sustain 6-12 months without organic leads, SEO produces a lower cost per case over the lifetime of the investment. For firms spending under $3,000/month total, Local Services Ads (pay-per-lead model) combined with aggressive Google Business Profile optimization is the most capital-efficient starting point because it limits risk to valid leads only and builds the local presence that accelerates future SEO results.

If the firm has zero existing revenue and needs signed cases to make payroll next month, PPC is the only answer and anything else is a theory that doesn’t help right now. You can’t compound something from zero cash flow, and the six months that SEO needs to exit the foundation phase is six months of invoices that a firm without revenue can’t survive.

If the firm has referral income or savings or any revenue source that covers operating expenses for the next six to twelve months, starting with SEO and adding PPC later is the cheaper path over the lifetime of the investment because every month of SEO that runs before PPC starts is a month of domain authority that makes the eventual organic leads cost less.

For firms at the lowest budget tier, maybe $1,500 to $3,000 a month total, Local Services Ads on a pay-per-lead basis combined with aggressive Google Business Profile optimization is the starting point because LSAs only charge for valid calls rather than clicks, which limits the downside risk, and the review velocity and local profile work that LSAs require is the same foundation that accelerates SEO results once the firm is ready to add that channel.

Want to see what your firm’s timeline looks like specifically?

Send me your practice area, market, and monthly budget and I’ll map the PPC vs SEO timeline for your specific situation, including where the crossover point falls and whether the blended approach or single-channel makes more sense given your cash flow.