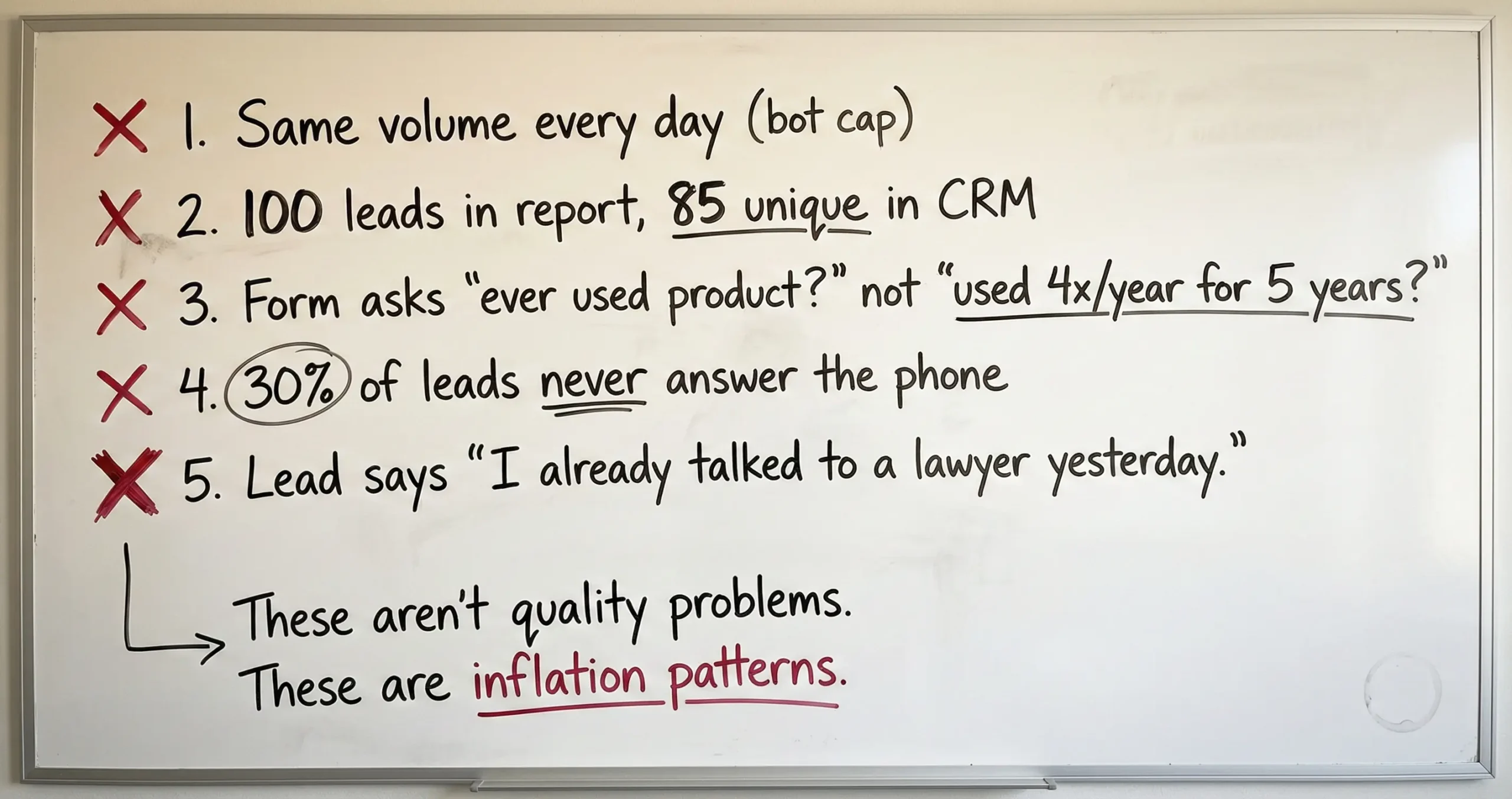

How do you know if a marketing agency is inflating lead numbers? Five patterns reveal it: perfectly consistent daily lead volume that indicates bot traffic, more leads in the agency report than unique contacts in the CRM, form questions that have been simplified to capture unqualified people, leads that never answer the phone or say they never filled out a form, and leads who say they already spoke to another lawyer yesterday. Each of these has a specific detection method that any firm can run on their own data without needing to understand the technology underneath.

Up to 25% of lead generation traffic in the legal industry is estimated to be fraudulent, which means roughly one out of every four leads your agency bills you for might be a bot, a recycled contact, or someone who never intended to contact a law firm. And the agency’s report won’t distinguish between the real ones and the fake ones because their incentive is to show volume, and filtering out the junk would make their numbers look worse.

I’ve covered how to audit your agency’s lead quality and how to evaluate whether leads are worth what you’re paying in other posts. This one is specifically about the inflation mechanics; how lead counts get padded, what the forensic patterns look like in the data, and how to catch each one without needing to understand the technology underneath it.

Sign 1 – The Lead Count Is Suspiciously Consistent

How do you detect bot traffic in law firm marketing leads? Real human traffic fluctuates with the news cycle, the day of the week, and random chance. If your agency’s report shows nearly the same number of leads every day – 48 on Monday, 51 on Tuesday, 49 on Wednesday – that consistency is a hallmark of automated bot traffic running at a programmed delivery cap. Other indicators include a significant percentage of leads arriving between 2 AM and 5 AM, and time-on-page metrics under 10 seconds for people who supposedly read a complex intake form before submitting it.

Real leads are messy. Monday brings 12 and Tuesday brings 43 and Wednesday brings 7 and nobody can explain the pattern because human behavior doesn’t follow a schedule. So when an agency report shows 50 leads on Monday, 48 on Tuesday, 52 on Wednesday, and the volume barely varies across an entire month, that smoothness is itself the red flag because real traffic doesn’t look like that.

And modern bots aren’t the obvious kind that fill out a form in 10 milliseconds with “asdf” in the name field. They route through real residential internet connections so the IP address looks legitimate, they scroll the page and pause over images and move the cursor in natural patterns, and some of them inject actual stolen personal data from data breaches.

So when your intake team calls the number, a real person answers but has no idea why a law firm is calling them. That “I never filled out a form” call is one of the most common signs that bot-generated leads are in your pipeline and nobody is filtering them out.

The simplest check you can run is to ask your agency for the raw data export with timestamps and look at the distribution. If more than 15% of leads arrive between 2 AM and 5 AM local time, or if the time-on-page for converted visitors averages under 10 seconds on a page that takes 2 minutes to read, the numbers are being inflated by something that isn’t human.

Sign 2 – The Agency’s Lead Count Doesn’t Match Your CRM

How do agencies double-count leads for law firms? Three ways: the same person submits a form twice because nobody called them back, an existing client clicks a retargeting ad and gets counted as a new lead, or the agency blends branded search traffic (people who searched your firm name) with cold prospecting traffic to make the average cost per lead look lower. The forensic check is to compare the agency’s monthly report against unique contacts in your CRM – if the agency says 100 and the CRM shows 85, that 15% gap is inflation.

Pull last month’s agency report and count the leads, then pull the same period from your case management system and count the unique contacts. Those two numbers should be close to identical and in most firms they’re not, and the gap between them is pure inflation that’s distorting every metric built on top of it.

The most common version of this is a single person who submits a form on Monday, doesn’t hear back, and submits again on Tuesday. The agency counts two leads because they’re measuring form submissions, not people. The CRM might catch the duplicate or it might not depending on how it’s configured, but either way the firm is being billed for two leads when the reality is one person who’s annoyed that nobody called them, which is an intake speed problem not a marketing success.

The sneakier version is brand search blending, which is when the agency bids on your firm name in Google Ads so that when someone who already knows you searches your name, the agency’s ad captures the click. That person was going to find you anyway, but now the agency gets credit for a “lead” that cost $5 to capture.

They mix it into the same report as the cold traffic leads that cost $300 each, and the blended average looks great on paper while hiding the fact that the prospecting campaigns, the ones actually doing new work, are performing worse than the combined number suggests.

Sign 3 – The Qualification Criteria Got Simpler

How do agencies lower lead quality to increase volume? By broadening the targeting and simplifying the intake form questions. Instead of targeting “ovarian cancer survivors” for a talcum powder campaign, they target “women over 40 interested in health.” Instead of asking “did you use hair relaxer at least 4 times per year for 5 years,” they ask “have you ever used hair relaxer.” Both changes produce more leads at a lower cost per lead, but the qualification rate drops so far that the cost per signed case goes up even though the report shows improvement.

If your agency’s lead volume went up but your signing rate went down, check whether anything changed on the intake form. One of the most common inflation tactics in mass tort marketing is to simplify the screening questions to let more people through, which makes the top of the funnel look productive while pushing all the rejection work onto the firm’s intake team.

The math on this is ugly in a way that doesn’t show up on marketing dashboards. An intake person costs about $25 an hour and can process maybe 6 leads per hour, so every lead that gets rejected costs roughly $4 in labor. If an agency delivers 1,000 leads with a 5% qualification rate instead of the 15% you’d expect from properly targeted campaigns, the firm processes 950 rejections at a cost of nearly $4,000 in intake labor that nobody accounts for as a marketing expense.

And beyond the dollars, there’s a morale cost that compounds over time. An intake team that spends 90% of its day telling people “we can’t help you” loses the energy and empathy needed to close the qualified cases when they finally show up. The lead quality problem starts in targeting and form design, but by the time it reaches intake it’s an operational problem that affects signing rates across the board.

Sign 4 – A Significant Percentage of Leads Never Answer the Phone

What is a phantom lead in law firm marketing? A lead that appears in the report but can’t be reached by phone. Quality lead sources have a 70 to 85% contact rate. Inflated sources often drop below 40%. Phantom leads come from three sources: incentivized traffic where someone filled out a form to win a prize, recycled data from months ago where the person has moved on, and bot-generated submissions using stolen personal information from data breaches. Beyond wasted intake time, phantom leads create TCPA liability because calling someone who never gave consent can result in fines of $1,500 per violation against the firm, not the agency.

A lead that never answers the phone isn’t just a wasted call, it’s a signal that something is wrong with how the leads were generated in the first place. If your contact rate is below 50%, the source is almost certainly contaminated with submissions from people who either didn’t intend to contact a law firm, filled out a form as part of an incentivized survey promising a gift card or sweepstakes entry, or never actually submitted anything because a bot did it using their personal information scraped from a data breach.

The legal exposure here is worse than the wasted budget. If someone’s phone number was submitted without their knowledge and your firm uses any kind of automated dialer or text system to contact them, the firm is liable under the Telephone Consumer Protection Act for up to $1,500 per violation. The agency delivered the lead, but the compliance risk lands on you because you made the call.

The detection method is straightforward: ask your agency to provide a consent verification certificate for every lead, which services like TrustedForm or Jornaya generate automatically by recording the user’s interaction with the form. If the agency can’t produce one, there’s no proof the person actually saw your intake page, agreed to be contacted, or submitted anything at all, and every lead without that verification is a liability sitting in your CRM.

Sign 5 – Leads Keep Saying They Already Talked to Another Lawyer

How do you know if your agency is selling shared leads? If your intake team frequently hears “I already spoke to a lawyer” or “someone called me about this yesterday,” the leads are being sold to multiple firms simultaneously. In shared lead models, 3 to 5 firms receive the same lead within minutes, creating a race where the first firm to call gets the case and everyone else paid for a dead contact. The detection check is timing analysis: if there’s a gap longer than a few seconds between when the lead was generated and when it hit your CRM, the agency may be shopping it through a real-time auction before delivery.

When the intake team starts hearing “I already signed with someone” on a regular basis, that’s not a coincidence and it’s not lead amnesia. The lead was sold to multiple firms at the same time, and whatever the agency is calling “exclusive” in the contract, the person on the other end of the phone is telling you the truth about what actually happened.

The mechanics work through what’s called a ping tree, where a lead gets generated on a generic legal help site and then auctioned in real time to whoever bids highest, with the same lead often going to 3 or 4 or 5 firms within seconds. Every agency in the chain reports “one lead generated” so the total reported volume across the industry is 500% of the actual number of people who submitted forms.

You can catch this by requesting the creation-to-delivery timestamps for every lead. The creation timestamp is when the person hit submit. The delivery timestamp is when the lead appeared in your system. If that gap is longer than a few seconds on a consistent basis, the lead is being routed through an intermediary, and a delay of even 5 minutes reduces your contact rate by up to 400% because by the time you call, three other firms already did.

Not sure if your lead numbers are real?

Send me last month’s agency report and the matching lead count from your CRM. I’ll tell you whether the numbers line up, where the gaps are, and what’s likely causing them. If the numbers are clean I’ll tell you that too and you can stop wondering.