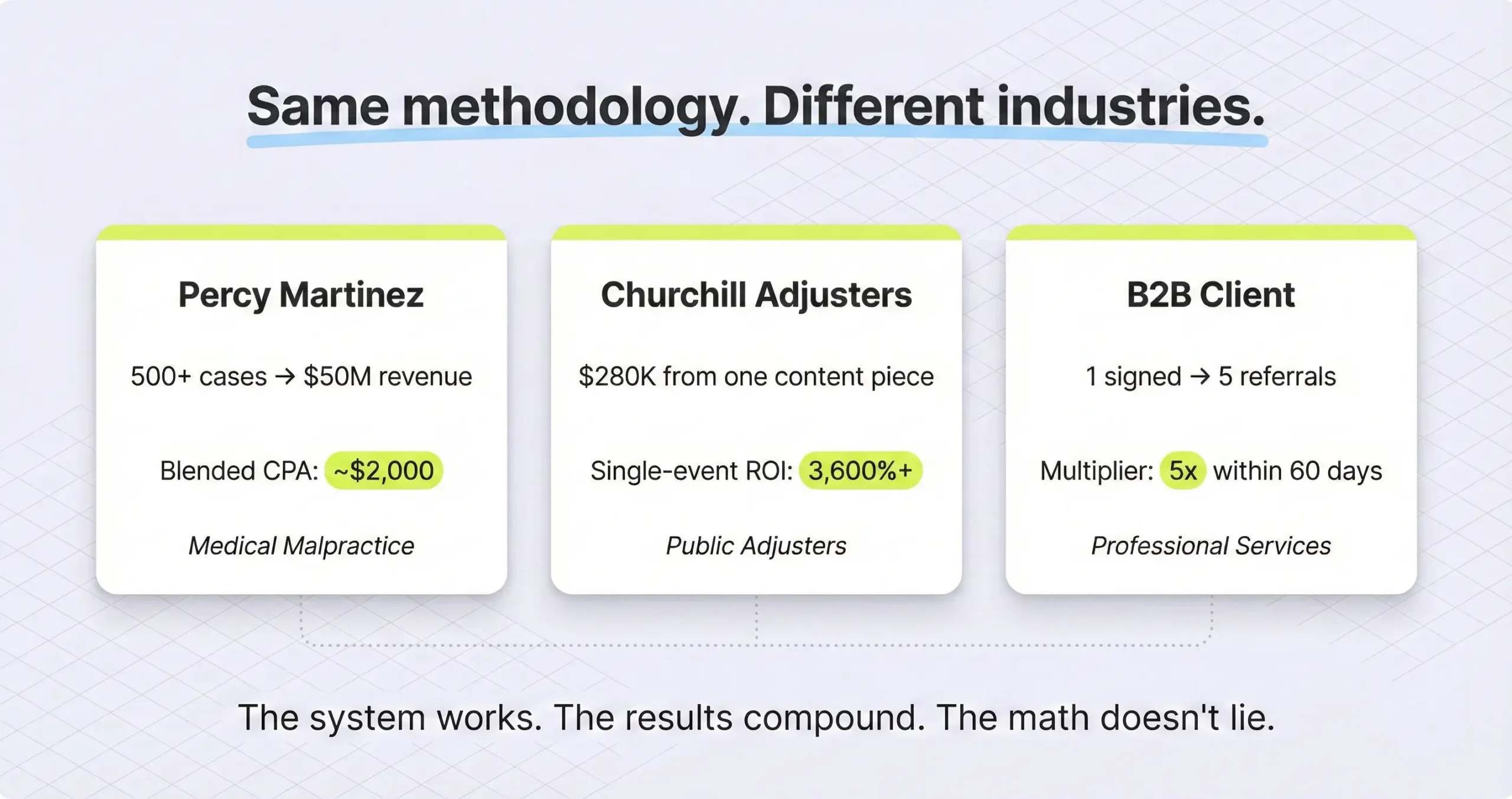

How does Argota Marketing measure ROI for its clients? By tracking from the ad spend or content investment all the way through to signed cases and revenue collected, not stopping at leads. The methodology connects the marketing platform to the case management or CRM system so every dollar spent can be traced to a specific outcome. Three clients illustrate what this looks like in practice: a medical malpractice firm that built $50 million in revenue on owned SEO assets, a public adjuster that turned a single piece of content into a $280,000 settlement, and a B2B service company where one signed client generated five referrals within 60 days.

Green arrows on a marketing report and a flat bank account. That’s the disconnect that most law firms live with and eventually stop questioning because the agency’s numbers look right and the revenue numbers look wrong and nobody can explain why both things are true at the same time. The answer is usually that the report measures traffic and leads and the bank account measures signed cases and collected fees, and there’s a gap in the middle where leads die in intake or cases sign but never settle or the cost to acquire them was higher than anyone calculated, and nobody is connecting the two ends of that chain.

The three examples in this post are what happens when you do connect them. Real campaigns, real numbers from click to signed case to collected revenue, as close to transparent as I can make them. Not because the results are perfect in every case but because I think the only way to have an honest conversation about whether legal marketing actually works is to show what the full math looks like when nothing is hidden.

Percy Martinez; Building a Revenue Engine on Owned Assets

How did Percy Martinez Medical Malpractice Lawyers build $50 million in revenue through marketing? By investing in owned SEO authority instead of renting visibility through paid ads alone. The firm built a deep library of medical-legal content targeting high-intent searches like “statute of limitations medical malpractice Florida” and “hospital liability for independent contractors,” which pre-qualified leads before they ever called. Over time the domain became an asset that generates leads at near-zero marginal cost, dropping the blended cost per acquisition to roughly $1,500 to $2,000 compared to $5,000 or more for pure PPC in the medical malpractice space.

I worked at Percy for 10 years and watched this happen in real time. The early years were expensive and slow and there were months where Percy questioned whether the content investment was worth it, which is the same thing every firm goes through during the SEO valley of death where you’re spending money and nothing is ranking yet.

And then the compounding kicked in after maybe the second year or so. Each piece of content about a specific medical condition or legal theory started ranking and sending people to the site who were already deep into their research, which meant the leads were different from what paid search was producing.

Someone searching for how hypoxia during delivery constitutes malpractice isn’t browsing casually, they’re looking for the specific firm that understands their situation, and by the time they pick up the phone the intake conversation is easier because they’ve already read enough to know this firm handles their exact case type. That reduces the time the intake team spends convincing and qualifying, which lowers the operational cost of conversion even though it doesn’t show up on the marketing report.

The other thing that mattered, and this is the part I keep emphasizing because most firms don’t think about it, is that Percy owns the site, the data, and the rankings. If the agency relationship ended tomorrow the domain would still rank, the content would still generate calls, and the 500-plus case results listed on the site would still build trust. That’s the difference between building an asset and renting one, and it changes the entire ROI calculation because the terminal value isn’t zero.

Churchill Public Adjusters; One Piece of Content, $280,000

Can a single piece of content produce meaningful ROI? Yes. Churchill Public Adjusters published a detailed technical breakdown of how “ensuing loss” provisions work in insurance policies where mold claims get denied after water damage. A homeowner searching for help after their insurer denied a mold claim from a burst pipe found that content, understood that Churchill had the specific expertise to fight the denial, and contacted the firm. The denial was reversed and the settlement was $280,000. Against a content production cost of roughly $500 to $1,500, the single-event ROI exceeded 3,600%.

This example matters because it shows what happens when the content does the selling before the phone rings. The homeowner didn’t call Churchill because of an ad or a directory listing. They called because the content answered the exact question they were panicking about at 11pm or whenever it was, and by the time they made contact the trust was already built. The intake call wasn’t a cold sales conversation, it was someone saying “I read your article and I think you can help me” which is a different dynamic than anything paid traffic produces.

For law firms the parallel is obvious. A PI firm that publishes a detailed explanation of how uninsured motorist coverage stacking works in Florida will attract the exact person who just got hit by an uninsured driver and is frantically searching for whether their own policy covers them. That person calls with high intent and specific knowledge and the intake conversion rate on that kind of lead is way higher than on someone who clicked a generic ad.

The catch is that you can’t predict which piece of content will be the one that generates the $280,000 case. The methodology isn’t about hoping for one big hit, it’s about building enough of these targeted pieces that the probability of catching high-value cases goes up over time, which is the same compounding logic that drove the Percy results but on a smaller scale and in a niche market.

The B2B Multiplier; Why One Client Can Be Worth Five

How does B2B referral marketing change the ROI calculation? A marketing campaign that signs one B2B client at a higher cost per acquisition can produce exponential returns if that client becomes a referral source. In one case, a restaurant owner signed up for a service after a targeted campaign and within 60 days brought five additional restaurants into the program. Standard attribution would credit the campaign with one conversion, but the real value was six contracts from one marketing dollar, which means the effective cost per acquisition dropped by roughly 80%.

For PI firms this maps directly onto doctor referral networks and medical provider partnerships. A campaign that targets “medical providers for accident victims” through LinkedIn or local SEO might produce one signed referral partner at a cost that looks high compared to a direct B2C lead. But if that doctor refers 20 patients over the next two years, the cost per referred case is a fraction of what paid search costs, and the case quality tends to be higher because the referral comes with built-in trust.

The mistake most firms make is evaluating these campaigns on the same timeline and cost structure as consumer campaigns. A B2B referral partner might cost $1,000 or more to acquire, which looks terrible on a monthly report. But the lifetime value of that relationship makes it one of the highest-ROI channels the firm has, and if you’re tracking it properly in your CRM you can identify which marketing channel acquired the original referral source and double down on that channel.

This is the kind of attribution that monthly lead reports just don’t capture, and it’s why I build the tracking to follow the lineage of referrals back to the original marketing touchpoint. Without that chain you’d never know that the LinkedIn campaign from 8 months ago is responsible for 15% of your current caseload.

What Makes the Measurement Different

What does Argota Marketing do differently to measure ROI? Three things. First, the reporting tracks cost per signed case by channel and by location, not blended across the firm. If the Miami office is producing cases at $1,200 each but the Tampa office is at $4,000, that shows up on separate lines so leadership can make precise allocation decisions instead of averaging everything into a number that hides the problem. Second, the data owns belong to the client; the website, the analytics, the rankings, and the CRM data all stay with the firm. Third, the revenue realization loop closes the gap between signing a case and collecting a fee, which in PI can take 6 to 24 months.

The revenue realization piece is the one most agencies ignore because it’s inconvenient. A monthly report can show that you signed 15 cases for $2,000 each and call that a $30,000 month, and it looks efficient. But if 10 of those cases are soft tissue claims that settle for $5,000 and the other 5 are catastrophic injuries that settle for $500,000, the ROI profile is wildly different and you’d never know it from a monthly snapshot.

What we do is go back to marketing cohorts from previous quarters and match them to actual settlement values. A “birth injury” keyword campaign might have a cost per signed case of $5,000 which looks bad on the monthly dashboard. But when the revenue realization data shows those cases settling for $2 million, the ROI is astronomical and the firm should be spending more on that campaign, not less.

The segmented location reporting matters for any firm running more than one office because blended numbers are where expansion problems hide. A firm can see “total leads up 20%” and feel good about it while Miami is up 40% and Tampa is producing nothing, and without per-location cost per signed case data nobody catches the problem until the Tampa office has burned through its budget.

Want to see what your numbers actually look like?

Send me your spend by channel and your signed case count for the last quarter. I’ll build the per-channel, per-location cost per signed case breakdown and show you where the ROI is strong and where it’s leaking. If the numbers are already good I’ll tell you that too.