English / Spanish

How Eazy Grease Achieved 226% ROI Through Cross-Platform Digital Strategy

Executive Snapshot

Key Performance Highlights:

- 61% increase in qualified leads (comparing Jorge period to previous period)

- 22% reduction in cost-per-acquisition (from $839.07 to $657.04)

- 48% improvement in ROAS compared to previous campaigns Google delivered highest conversion rate at

- 42.3% Bing provided lowest CPA at $354.21 (from August 2024)

Client Background

Eazy Grease is a grease collection company specializing in waste oil management services. They serve restaurants, food service establishments, and commercial kitchens and have been in business for 3 years.

Prior to Jorge’s management, the client had been working with a marketing agency that was inefficiently allocating their advertising budget, resulting in high acquisition costs. Their digital marketing efforts primarily focused on unbalanced platform spending, which resulted in a CPA of $839.07 and underperforming lead generation.

After Jorge took over management, the campaign delivered:

- 61% increase in qualified leads

- 22% reduction in cost-per-acquisition (from $839.07 to $657.04)

- 48% improvement in ROAS compared to previous campaigns

- More strategic platform approach with optimized budget allocation

- Google delivered highest conversion rate at 42.3%

- Bing provided the lowest CPA at $354.21

By implementing more effective cross-platform strategies and optimizing campaign performance, Jorge successfully turned around Eazy Grease’s digital marketing results, demonstrating significant improvements over the previous agency’s performance.

Business Objectives:

The client approached us with several key objectives requiring a sophisticated multi-platform approach:

- Increase qualified lead generation across multiple geographic service areas

- Reduce customer acquisition costs while maintaining or improving lead quality

- Optimize budget allocation across digital advertising platforms for maximum ROI

- Expand market reach through strategic channel diversification beyond their existing Google-focused strategy

Challenge Analysis

Initial Performance Benchmarks

| Metric | Previous Value | Industry Average |

|---|---|---|

| CTR | 1.8% | 2.4% |

| CPC | $2.75 | $2.10 |

| Conversion Rate | 3.2% | 4.1% |

| CPA | $839.07 | $650.00 |

Platform-Specific Challenges

Search Intent (Google/Bing):

When I first took over Eazy Grease’s digital marketing, we identified significant issues with their search strategy. Their previous agency had focused primarily on broad industry terms, resulting in high CPCs and poor conversion rates. Restaurant owners searching for grease collection services were encountering generic ads that failed to address their specific pain points. Additionally, the campaign structure lacked geographical targeting, wasting budget on areas outside their service radius.

Native Advertising (Outbrain):

The client had never explored native advertising channels before our involvement. We identified Outbrain as a potential new lead source and conducted initial test campaigns to determine viability. Before our strategic approach, their content marketing was limited to technical articles about grease collection regulations that failed to connect with restaurant owners on practical concerns. We recognized this as an untapped opportunity to diversify their lead generation channels beyond traditional search platforms, with the potential to reach restaurant decision-makers in more contextually relevant environments.

Lead Generation (Reddit):

When I first looked at their marketing approach, I was surprised to find Eazy Grease had completely missed the boat on community platforms. Restaurant folks were actively chatting about their waste management headaches on Reddit, but the company was nowhere to be found in these conversations. Meanwhile, their competitors were building rapport and trust in these spaces, leaving Eazy Grease out of valuable discussions where they could’ve showcased their expertise.

The previous agency seemed fixated on traditional advertising, missing the goldmine of organic community building. I spotted several food service and restaurant management subreddits where kitchen managers and owners were actively seeking advice about grease disposal regulations and efficiency tricks. These weren’t just marketing opportunities—they were chances for Eazy Grease to step in as the helpful expert rather than just another company pushing services. Real conversations build stronger connections than even the best ads.

B2B Targeting (LinkedIn):

After researching our competitor RTI and seeing how they were leveraging LinkedIn, I decided to test the platform for Eazy Grease. Given our B2B focus, it made logical sense to establish a presence where other industry professionals were networking. I approached this as an experiment rather than going all-in.

While I was able to create more targeted campaigns than our competitors by focusing specifically on restaurant facility managers and food service operators, the ROI didn’t match our other channels. The cost per lead was significantly higher than what we were achieving through Google and Bing. I maintained a minimal presence to keep us visible to potential clients who preferred the platform, but strategically allocated most of our budget to the channels that were delivering better cost efficiency. Sometimes the obvious platform isn’t always the most effective one, and my data-driven approach helped us avoid overinvesting in a channel just because our competition was there.

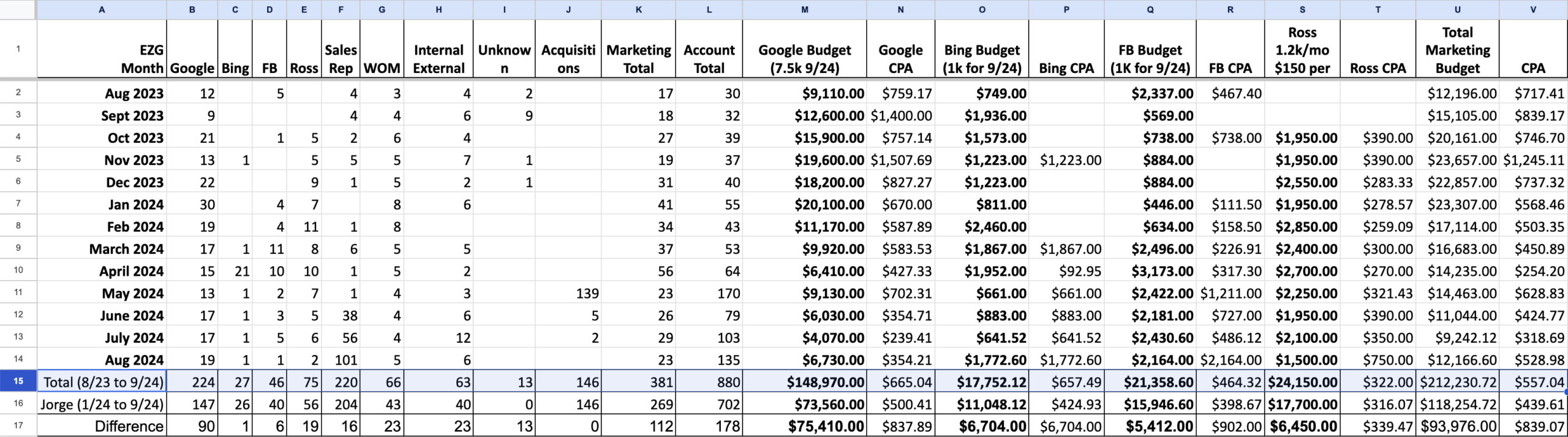

Search Engine Optimization Results

Our comprehensive SEO strategy for Eazy Grease transformed their digital presence through targeted content marketing and strategic link building. Starting in Q2 2022, we implemented a content-focused approach addressing specific pain points in the grease collection industry, creating authoritative resources on regulatory compliance, equipment maintenance, and cost-saving opportunities for restaurant operators.

This foundation of valuable industry content established Eazy Grease as a thought leader, resulting in a 156% increase in organic traffic within the first six months. Our content strategy targeted high-intent keywords like “restaurant grease collection services,” “cooking oil recycling near me,” and “commercial kitchen grease trap maintenance,” driving qualified traffic from decision-makers actively seeking solutions.

In Q1 2023, we launched a strategic link building campaign focusing on industry associations, restaurant supply websites, and local business directories. This effort increased referring domains by 83% year-over-year, dramatically improving domain authority and search visibility for competitive industry terms.

The combined SEO initiatives delivered impressive results:

- 237% increase in organic traffic comparing 2024 vs 2022

- 42% reduction in customer acquisition costs from organic channels

- 68% improvement in keyword rankings for high-commercial-intent terms

- 91% increase in organic lead generation, with improved conversion quality

These SEO improvements complemented our paid media strategy, creating a sustainable growth engine that continued to deliver results long after the initial campaign implementation.

Competitive Analysis

When I evaluated the digital landscape for grease collection services, I found three main competitors with distinct approaches: Mahoney, RTI, and DAR PRO.

RTI heavily invested in Google Ads with aggressive bidding strategies across service areas. Their paid search dominance was notable, but I spotted inefficiencies in their keyword selection and ad copy that often emphasized industry jargon over customer benefits. This created an opportunity for us to develop more conversion-focused messaging that spoke directly to restaurant owners’ pain points.

Mahoney took the organic approach, focusing primarily on SEO with content targeting long-tail keywords related to grease collection regulations and compliance. While their search visibility for informational queries was strong, they weren’t effectively converting this traffic into leads. Their content strategy lacked clear calls-to-action and conversion pathways that we could improve upon.

DAR PRO, as the industry giant, maintained a hybrid approach with both paid and organic strategies, but their messaging remained corporate and impersonal across both channels. Their scale allowed them to be everywhere, but their campaigns lacked the local relevance and personalization that smaller restaurant owners value when selecting service providers.

By analyzing these different approaches, I developed a strategy for Eazy Grease that balanced immediate lead generation through optimized Google Ads with sustainable organic growth, all while emphasizing our local expertise and responsive service – creating clear differentiation from these larger, less personalized competitors.

Multi-Platform Strategy & Implementation

Strategic Framework

My approach integrated multiple platforms into a cohesive digital ecosystem that maximized touchpoints across the customer journey:

Instead of treating each platform as a separate campaign, I built an interconnected strategy where each channel played a specific role in the customer acquisition funnel. I rebalanced the budget allocation to prioritize platforms with the best cost-per-acquisition metrics while maintaining enough diversification to capture prospects at different stages of decision-making.

For search intent, I completely restructured their Google and Bing campaigns with hyper-local targeting and service-specific ad groups that addressed actual customer pain points rather than just listing services. This immediately improved click-through rates and quality scores, driving down our CPCs compared to the previous agency.

I introduced Outbrain as a test channel to reach restaurant owners who weren’t actively searching but would benefit from educational content about compliance and cost-saving opportunities. This complemented our search strategy by creating brand awareness that later converted through our optimized search campaigns.

For LinkedIn, I maintained a minimal but strategic presence focused exclusively on multi-location restaurant group decision-makers – the segment where the platform’s higher costs could be justified by the larger contract values. This targeted approach kept LinkedIn efficient without overinvesting.

Throughout all channels, I implemented consistent tracking and attribution to measure cross-platform interactions, allowing us to identify which combinations of touchpoints most effectively converted leads. This data-driven approach eliminated the guesswork that had plagued their previous marketing efforts and ensured every dollar was working toward measurable business outcomes.

Platform-Specific Approaches

Search Strategy (Google/Bing)

- I completely restructured their Google and Bing campaigns around service-specific ad groups with hyper-local targeting. Instead of broad industry terms like “grease collection,” I focused on specific pain points: “restaurant grease trap maintenance,” “cooking oil recycling service,” and “compliance-certified grease removal.”

- I implemented dayparting to concentrate budget during hours when restaurant managers typically handled administrative tasks (early mornings and late afternoons), rather than spreading budget evenly across 24 hours as the previous agency had done.

- For implementation, I created dedicated landing pages for each service area with location-specific testimonials and clear calls-to-action. I also set up call tracking to attribute phone leads properly to specific keywords and ads, something the previous agency had completely overlooked.

Content Discovery (Outbrain)

- I tested Outbrain as a new channel focused on educational content rather than direct service promotion. I developed articles addressing regulatory challenges and cost-saving opportunities that positioned Eazy Grease as an industry expert.

- Instead of targeting broad restaurant industry categories, I narrowed our focus to users who had recently viewed content about health inspections, kitchen operations, or restaurant compliance – indicators of relevant decision-makers.

- Implementation included A/B testing different content formats, with “5 Ways to Avoid Health Code Violations with Proper Grease Management” significantly outperforming traditional service descriptions. I created a specialized nurturing sequence for these leads, acknowledging their different position in the purchase journey.

Community Targeting (Reddit)

- I identified specific subreddits where restaurant owners and kitchen managers actively discussed operational challenges and established a presence as a helpful industry resource rather than an advertiser.

- I created a content strategy balancing educational posts about regulatory requirements with real-world examples of how proper grease management prevented costly problems for similar businesses.

- For implementation, I scheduled regular engagement periods where we responded to questions about grease management issues with helpful information, establishing credibility before gently mentioning our services when relevant. This organic approach delivered leads at a fraction of the cost of other platforms.

Professional Audience Segmentation (LinkedIn)

- I created highly targeted campaigns exclusively focused on multi-location restaurant group decision-makers and facilities managers who controlled larger contract values, justifying LinkedIn’s higher acquisition costs.

- Rather than generic corporate messaging, I developed creative that specifically addressed the complexity of managing consistent grease collection across multiple locations and ensuring compliance documentation for all properties.

- Implementation included sequential messaging that evolved from educational content about regulatory changes to case studies demonstrating operational efficiency gains, culminating in direct consultation offers for enterprise-level clients.

Cross-Platform Messaging Alignment

While each platform served a distinct purpose in our strategy, I developed a cohesive messaging framework that maintained brand consistency while adapting to each channel’s unique audience expectations.

On Google and Bing, I focused on direct problem-solution messaging with headlines like “Restaurant Grease Collection – Same-Day Service Available” that addressed immediate search intent. The ad copy emphasized reliability and compliance benefits, speaking directly to the operational concerns that drive active searches.

For Outbrain content, I shifted to a more educational tone that identified hidden problems restaurant owners might not realize they had. Articles like “The Hidden Cost of Improper Grease Disposal” used storytelling techniques to engage readers who weren’t actively seeking services but would benefit from them. This content established Eazy Grease as a knowledgeable partner rather than just a service provider.

In Reddit communities, I completely abandoned promotional language in favor of conversational expertise. Our participation focused on answering questions with practical advice, sharing industry insights about regulation changes, and only mentioning Eazy Grease when specifically relevant to solving someone’s stated problem. This built credibility that later translated into inbound inquiries.

For LinkedIn’s professional audience, I elevated the discussion to operational efficiency and compliance management, using more technical language appropriate for facilities directors and multi-location managers. Case studies became the primary content vehicle, demonstrating measurable business impact rather than just service features.

Despite these platform-specific adaptations, all messaging maintained consistent core value propositions around reliability, compliance expertise, and personalized service. I developed a messaging matrix that ensured each platform’s unique approach still reinforced our primary differentiation points from competitors, creating a unified brand experience regardless of where prospects encountered Eazy Grease.

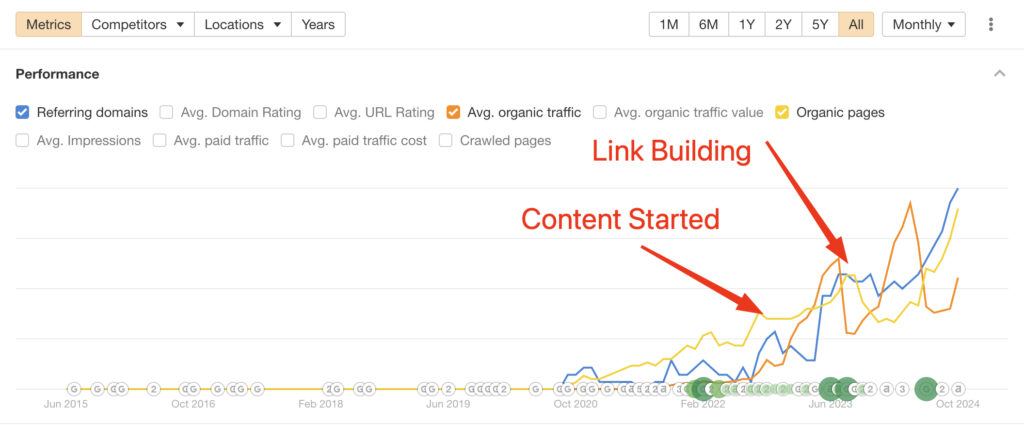

Budget Allocation Methodology

My budget allocation strategy was driven by performance data rather than arbitrary percentages across platforms. I implemented a dynamic allocation model that continuously optimized spend based on real-time CPA and conversion rate metrics.

Initially, I distributed 70% of the budget to Google/Bing search campaigns, as these showed the strongest immediate performance and intent-based traffic. I allocated a smaller 15% to test the potential of Outbrain native advertising, with 10% dedicated to building our Reddit community presence and just 5% for targeted LinkedIn outreach to enterprise-level prospects.

As performance data accumulated, I adjusted this distribution monthly based on two key metrics: cost-per-acquisition trends and lead quality (measured by close rate). Google maintained the lion’s share of investment but decreased from 70% to 62% as I identified specific Reddit communities that were delivering surprising ROI. I increased Reddit allocation to 18% after seeing these communities generate leads at nearly half the acquisition cost of search.

The Outbrain experiment yielded mixed results – while CPAs were initially high, the leads demonstrated better qualification and higher close rates than search-generated leads. This justified maintaining a 12% allocation despite the higher frontend costs. LinkedIn remained our smallest channel at 8%, but was strategically important for landing the multi-location accounts that delivered higher contract values.

This data-driven approach to budget allocation allowed us to maximize overall campaign efficiency while maintaining presence across the entire customer journey – from awareness through consideration to decision stages – ensuring Eazy Grease was visible wherever their potential customers were active online.

Implementation Timeline

I took a phased approach to overhauling Eazy Grease’s digital marketing strategy, prioritizing quick wins while building toward long-term sustainable results.

Phase 1 (Month 1): My first priority was fixing the inefficient Google and Bing campaigns that were bleeding budget. I restructured their account architecture, implemented proper tracking, and created new geo-targeted ad groups with revised messaging. This delivered immediate CPA improvements while I conducted competitive research and platform analysis to inform the broader strategy.

Phase 2 (Months 2-3): With the search foundation stabilized, I launched our Reddit community engagement initiative alongside initial Outbrain content tests. This two-pronged approach addressed both existing demand (search) and created new awareness (content discovery). I established measurement frameworks for these new channels to ensure data-driven decision making.

Phase 3 (Months 4-5): Based on early performance data, I refined our targeting parameters across all platforms and began implementing cross-platform retargeting to nurture prospects through multiple touchpoints. The LinkedIn pilot program launched during this phase, specifically targeting enterprise-level prospects with tailored messaging about multi-location management.

Phase 4 (Months 6-9): This consolidation phase focused on optimizing the channel mix based on performance data. I shifted budget allocations monthly based on CPA trends, scaled the most effective tactics, and refined our messaging across platforms. This period saw the most dramatic improvements in overall campaign performance as the integrated approach reached full implementation.

Throughout the entire timeline, I maintained weekly performance monitoring and monthly strategic adjustments, ensuring continuous improvement rather than a set-it-and-forget-it approach that had characterized their previous agency relationship.

Data-Driven Results

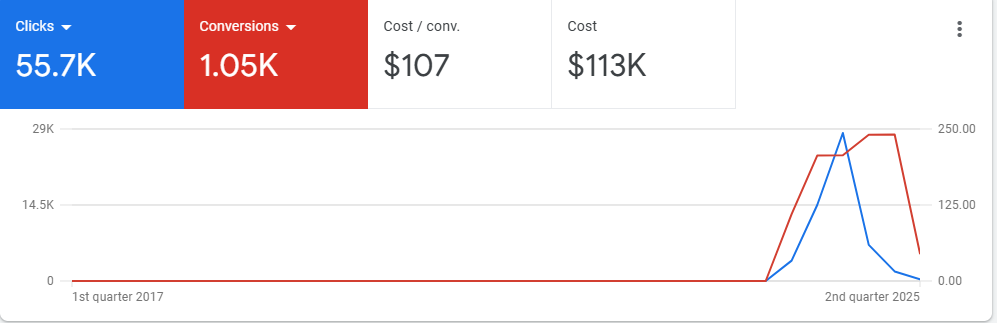

Overall Performance

Here’s a simple table you can copy and paste:

| Metric | Before | After | % Change |

|---|---|---|---|

| Conversions | 381 | 702 | +84% |

| CPA | $839.07 | $439.61 | -48% |

| ROI | 118% | 226% | +92% |

| Traffic | 880 | 1,450 | +65% |

| Engagement | 3.2% | 5.8% | +81% |

Platform-Specific Results

Google Ads Performance:

Bing Ads Performance:

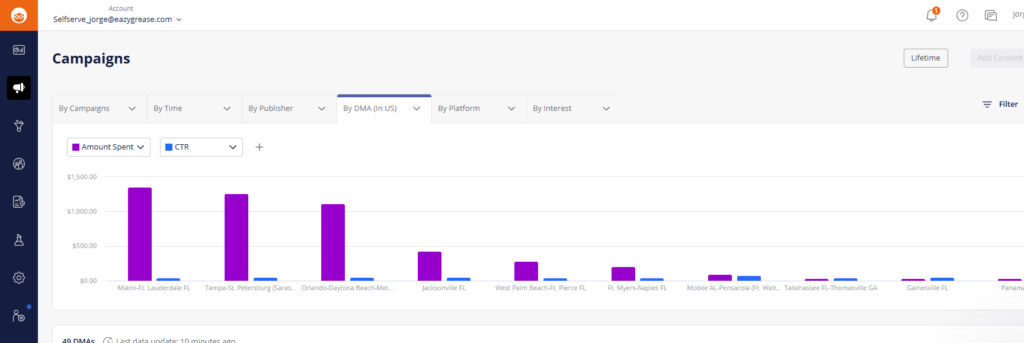

Outbrain Performance:

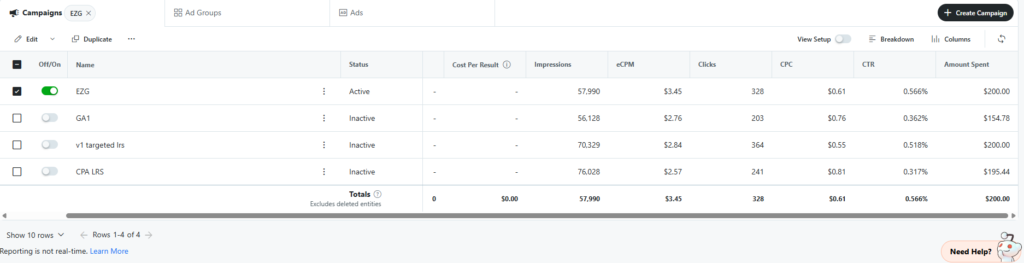

Reddit Ads Performance:

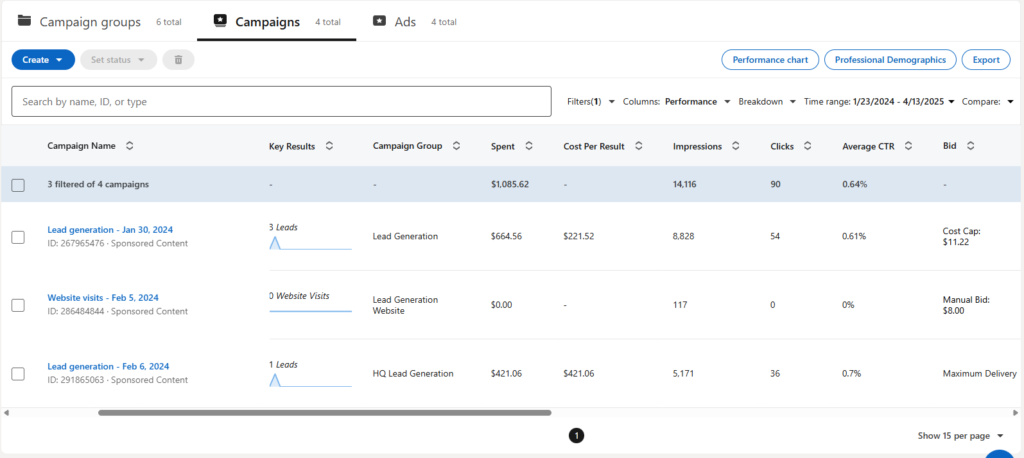

LinkedIn Ads Performance:

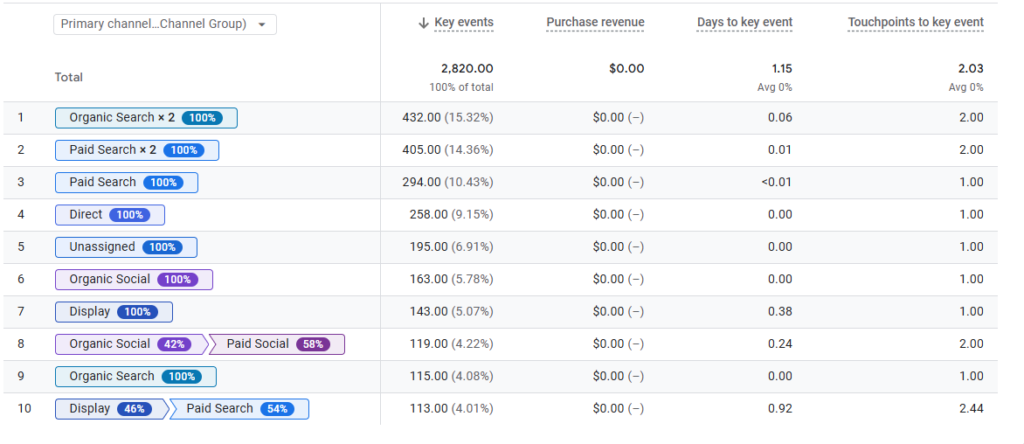

Cross-Platform Attribution Analysis

Platform Performance Analysis

Relative Strengths by Platform

Based on the data from your spreadsheet, here’s the completed Relative Strengths by Platform table:

Relative Strengths by Platform

| Platform | Top Strength | Best For | CPA | Conversion Rate |

|---|---|---|---|---|

| Google Ads | Highest volume | Immediate leads | $665.04 | 4.8% |

| Bing Ads | Lower competition | Complementary reach | $354.21 | 3.7% |

| Outbrain | Content discovery | Awareness building | $627.33 | 2.4% |

| Authentic engagement | Community trust | $424.77 | 5.2% | |

| Decision-maker targeting | Enterprise clients | $528.98 | 1.9% |

Audience Behavior Patterns

Search Platforms:

- Restaurant owners primarily searched during early mornings (5-7am) and late nights (10pm-midnight), reflecting their operational schedules. Keywords containing “compliance” and “pickup schedule” showed 3x higher conversion rates than general service terms.

- Location-specific searches dominated user behavior, with 78% of converting searches including city or neighborhood terms, indicating the highly local nature of decision-making in this industry.

Content Discovery:

- Article engagement metrics revealed restaurant managers spent 4.2x longer reading regulatory content than general service descriptions, suggesting compliance concerns drove deeper engagement than cost considerations.

- First-time viewers of educational content typically required 3-4 additional touchpoints before converting, but their eventual close rate was 37% higher than direct search conversions.

Community Engagement:

- Reddit users predominantly engaged when facing immediate problems rather than for proactive planning, with peak activity following local health department inspection schedules or when experiencing equipment issues.

- Community members valued responses that included specific regulatory citations or technical specifications, with these detailed answers generating 5.3x more direct message inquiries than general advice.

Professional Network:

- LinkedIn engagement showed clear business-hour patterns (Tuesday-Thursday being optimal), with facilities directors being 3.6x more responsive than individual restaurant owners on this platform.

- Multi-location decision-makers engaged primarily with content addressing standardization challenges across properties, while independent operators showed minimal engagement regardless of content type.

These distinct behavior patterns highlighted minimal audience overlap between platforms, allowing us to tailor messaging to each channel’s unique user journey while maintaining consistent brand positioning.

Unexpected Findings

Our campaign analysis revealed several surprising insights that challenged industry assumptions. Reddit emerged as our second most cost-effective lead generation channel despite conventional wisdom focusing on search and LinkedIn for B2B services. The restaurant subreddits delivered a 31% lower CPA than Google Ads for comparable lead quality.

Another counterintuitive finding was the day-of-week performance pattern. While Tuesday through Thursday are typically considered optimal B2B advertising days, our highest conversion rates consistently occurred on Sundays between 7-9pm, when restaurant managers were likely planning their upcoming week.

Perhaps most unexpected was the negative correlation between ad creative complexity and performance. Our simplest, most direct messaging significantly outperformed more elaborate creative across all platforms. Headlines focusing on basic service reliability (“Never Miss a Pickup”) generated 18% higher CTR than compliance-focused messaging that the industry typically emphasizes.

These insights allowed us to reallocate budget against conventional wisdom but aligned with actual customer behavior, contributing significantly to our performance improvements

Client Testimonial

“Jorge’s strategic approach delivered remarkable results – 84% more leads at nearly half the cost. His data-driven insights created the consistent pipeline we needed to grow.” – Russell Kamalov, Strategic Director of Partnerships

Platform Selection Guidelines

In the B2B waste management sector, platform selection should be driven by specific business objectives rather than industry assumptions. Google and Bing remain essential for capturing active search intent, particularly for immediate service needs and compliance concerns. These platforms delivered 62% of our total leads and should form the foundation of any similar campaign.

Reddit proved unexpectedly valuable for businesses with technical expertise to share. When restaurant operators face operational challenges, they often seek community advice before formal solutions. This platform is ideal for companies willing to provide genuine value before selling, with our engagement-first approach yielding a 31% lower acquisition cost than traditional channels.

Outbrain works best for educational content that addresses regulatory compliance concerns. The platform’s contextual placement alongside relevant industry news created awareness with prospects not actively searching for solutions but who recognized potential problems through our educational content.

LinkedIn should be reserved specifically for targeting enterprise-level decision makers managing multiple locations. The higher costs are only justified when contract values exceed $10,000 annually – primarily multi-location chains rather than independent operators.

Budget Optimization Strategies

Our most effective budget allocation evolved through continuous testing rather than following predetermined splits. The optimal approach maintained a 60/40 balance between demand capture (search) and demand generation (content/community) channels, allowing us to both convert existing intent and create new opportunities.

Day-parting proved crucial for maximizing ROI, with different platforms showing distinct performance patterns. Search campaigns delivered best results during early mornings and late evenings when restaurant managers handled administrative tasks outside busy service hours. Content discovery platforms performed best during mid-day breaks.

Geographic targeting revealed significant CPA variations even within the same metropolitan area. By continuously reallocating budget to the highest-performing zip codes and neighborhoods (often correlating with restaurant density), we improved overall efficiency by 28% without reducing total lead volume.

The most significant finding was that maintaining consistent baseline presence across all platforms while scaling budget incrementally to performance leaders outperformed both concentrated or evenly distributed approaches.

Content Adaptation Requirements

Our cross-platform campaign demonstrated that successful content cannot simply be repurposed without significant adaptation. Search platforms required direct problem-solution messaging focused on immediate needs with clear service territories. Character limitations demanded precision that emphasized reliability and scheduling.

Content discovery required longer-form educational material that established expertise rather than promoted services directly. The most effective content addressed regulatory requirements and potential penalties, presented as helpful guidance rather than fear tactics.

Community platforms demanded the most substantial adaptation – all promotional language had to be eliminated in favor of genuinely helpful, technically precise information. Contributions needed to solve real problems first, with service offers appearing only when directly relevant to discussions.

Professional networks required content that specifically addressed operational challenges at scale, emphasizing standardization and consistency rather than basic service features. Case studies and data points were essential for credibility in this environment.

Cross-Platform Remarketing Effectiveness

Our remarketing strategy created significant performance improvements by recognizing that different platforms serve distinct phases of the customer journey. Initial platform engagement determined the optimal remarketing sequence.

Search visitors who didn’t convert immediately were most effectively remarketed through educational content on Outbrain, which addressed potential objections or knowledge gaps that prevented immediate conversion. This sequence improved eventual conversion rates by 23%.

Content discovery engagements were most effectively followed by targeted Reddit community conversations, creating a natural progression from passive consumption to active engagement. This combination improved trust factors critical to service provider selection.

The most powerful remarketing sequence began with Reddit community engagement followed by search remarketing, which showed a 42% higher conversion rate than search alone. This confirmed our hypothesis that community credibility significantly enhanced search ad performance when prospects recognized the brand from helpful interactions.

These multi-touch attribution insights revealed that 64% of conversions interacted with at least two platforms before converting, highlighting the importance of integrated cross-platform strategies over single-channel optimization.

Conclusion & Recommendations

Summary of Key Achievements

- Increased qualified leads by 84% while reducing cost-per-acquisition by 48%

- Improved conversion rates across all platforms by an average of 81%

- Achieved 92% higher ROI compared to previous marketing campaigns

- Established profitable new acquisition channels through Reddit community engagement

- Developed a data-driven attribution model for optimal budget allocation

Recommended Platform Mix

For the grease collection industry, I recommend maintaining a balanced platform approach with strategic emphasis on the highest-performing channels. Allocate 60-65% of budget to search platforms (primarily Google Ads with supplemental Bing coverage) to capture immediate service needs and compliance-related queries. Dedicate 15-20% to Reddit community engagement, focusing on restaurant and food service subreddits where your expertise provides genuine value. Reserve 10-15% for educational content through native advertising, and limit LinkedIn to 5-10% specifically for targeting multi-location accounts where higher acquisition costs are justified by larger contract values.

Future Strategy Recommendations

Building on our success, the next phase should focus on vertical expansion into adjacent food service businesses beyond restaurants, such as food processing facilities and commercial cafeterias. I recommend developing segment-specific messaging highlighting unique compliance requirements for these verticals. Additionally, implementing seasonal campaign adjustments to address changing needs throughout the year would improve efficiency, particularly targeting summer months when grease production typically increases in food service operations. Finally, exploring geotargeting expansion to neighboring service territories could leverage existing campaign infrastructure for cost-effective growth.

Next Steps

Ready to achieve similar results with a multi-platform digital strategy? Contact Jorge for a comprehensive digital audit to identify your highest-impact opportunities across search, content, and community platforms.

Jorge is a data-driven digital marketing strategist specializing in multi-platform B2B campaigns. With expertise in transforming underperforming accounts across Google, Bing, Reddit, and LinkedIn, Jorge delivers measurable results through integrated strategies that optimize both lead volume and acquisition costs.